| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 136 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

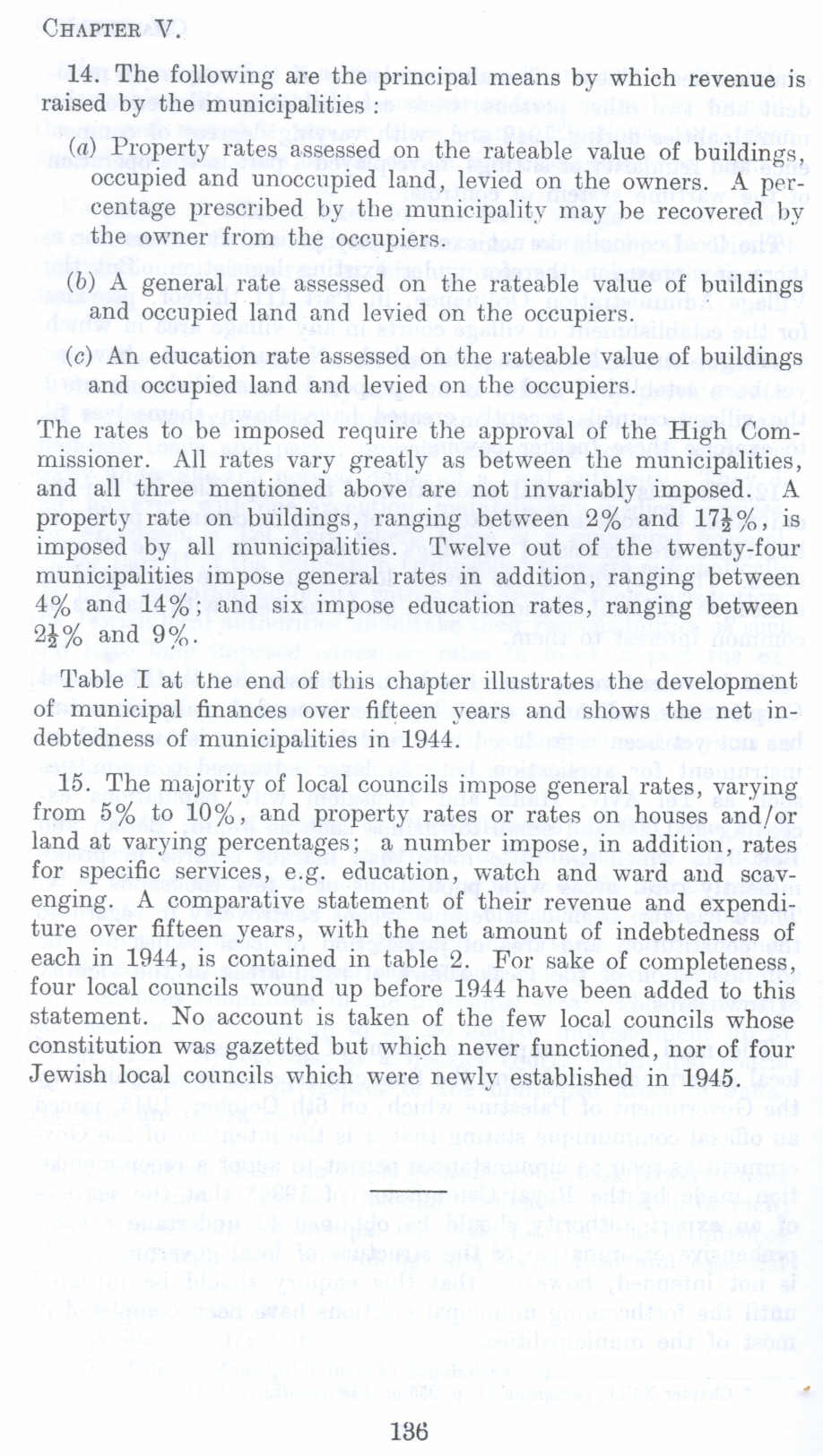

14. The following are the principal means by which revenue is raised by the municipalities :

(a) Property rates assessed on the rateable value of buildings, occupied and unoccupied land, levied on the owners. A percentage prescribed by the municipality m'1y be recovered by the owner from the occupiers.

(b) A general rate assessed on the rateable value of buildings and occupied land and levied on the occupiers.

(c) An education rate assessed on the rateable value of buildings

and occupied land and levied on the occupiers.

The rates to be imposed require the approval of the High Commissioner. All rates vary greatly as between the municipalities, and all three mentioned above are not invariably imposed. A property rate on buildings, ranging between 2% and 17!%, is imposed by aII municipalities. Twelve out of the twenty-four municipalities impose general rates in addition, ranging between 4% and 14%; and six impose education rates, ranging between 2!% and 9%.

Table I at the end of this chapter illustrates the development of municipal finances over fifteen years and shows the net indebtedness of municipalities in 1944.

15. The majority of local councils impose general rates, varying from 5% to 10%, and property rates or rates on houses and/or land at varying percentages; a number impose, in addition, rates for specific services, e.g. education, watch and ward and scavenging. A comparative statement of their revenue and expenditure over fifteen years, with the net amount of indebtedness of each in 1944, is contained in table 2. For sake of completeness, four local councils wound up before 1944 have been added to this statement. No account is taken of the few local councils whose constitution was gazetted but which never functioned, nor of four Jewish local councils which were newly established in 194.5.

Page 136