| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 229 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

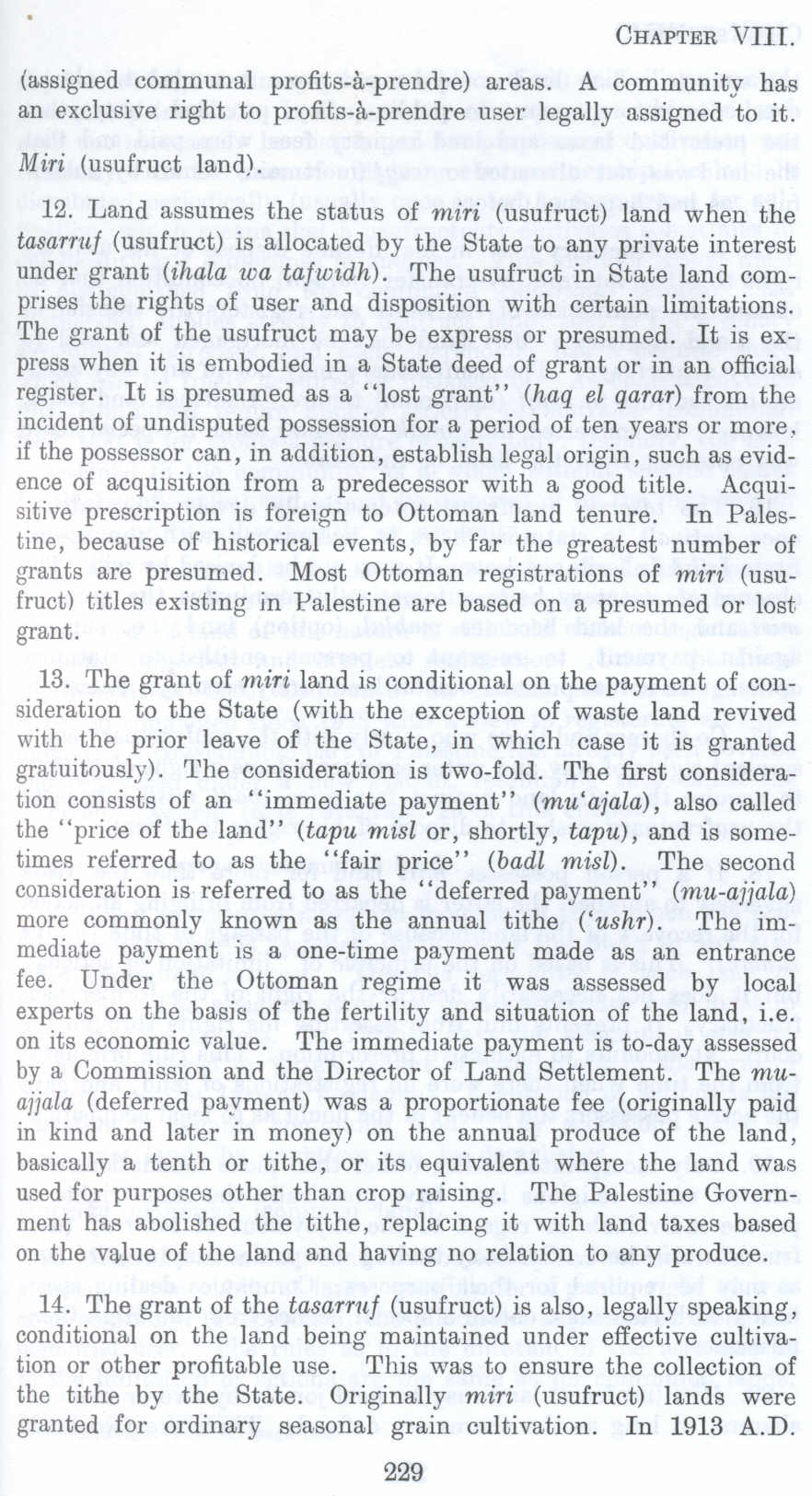

(assigned communal profits-a-prendre) areas. A community has an exclusive right to profits-a-prendre user legally assigned to it.

Miri (usufruct land).

12. Land assumes the status of miri (usufruct) land when the tasarruf (usufruct) is allocated by the State to any private interest under grant (ihala wa tafwidh). The usufruct in State land comprises the rights of user and disposition with certain limitations. The grant of the usufruct may he express or presumed. It is express when it is embodied in a State deed of grant or in an official register. It is presumed as a "lost grant" (haq el qarar) from the incident of undisputed possession for a period of ten years or more, if the possessor can, in addition, establish legal origin, such as evidence of acquisition from a predecessor with a good title. Acquisitive prescription is foreign to Ottoman land tenure. In Palestine, because of historical events, by far the greatest number of grants are presumed. Most Ottoman registrations of miri (usufruct) titles existing in Palestine are based on a presumed or lost grant.

13. The grant of miri land is conditional on the payment of consideration to the State (with the exception of waste land revived with the prior leave of the State, in which case it is granted gratuitously). The consideration is two-fold. The first consideration consists of an "immediate payment" (m1i'aiala), also called the "price of the land" (tapu misl or, shortly, tapu), and is sometimes referred to as the "fair price" (badl misl). The second consideration is referred to as the "deferred payment" (mu-frala) more commonly known as the annual tithe ('ushr). The immediate payment is a one-time payment made as an entrance fee. Under the Ottoman regime it was assessed by local experts on the basis of the fertility and situation of the land, i.e. on its economic value. The immediate payment is to-day assessed by a Commission and the Director of Land Settlement. The muajjala (deferred payment) was a proportionate fee (originally paid in kind and later in money) on the annual produce of the land, basically a tenth or tithe, or its equivalent where the land was used for purposes other than crop raising. The Palestine Government has abolished the tithe, replacing it with land taxes based on the value of the land and having no relation to any produce.

14. The grant of the tasarruf (usufruct) is also, legally speaking, conditional on the land being maintained under effective cultivation or other profitable use. This was to ensure the collection of the tithe by the State. Originally miri (usufruct) lands were granted for ordinary seasonal grain cultivation. In 1913 A.D.

Page 229