| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

House And Land Tax in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume I - Page 247. Chapter VIII: Land: Section 4: System of Land Taxation |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

years immediately preceding the application of the Ordinance to it, and was distributed by village committees under official supervision on the basis of the productivity of the land in cereals or fruit trees.

The produce of any land utilised for the purpose of agricultural instruction or research, was exempted from tithe and remissions were granted when there was destruction or failure of crops, or a fall in prices, except in the case of areas planted with citrus trees.

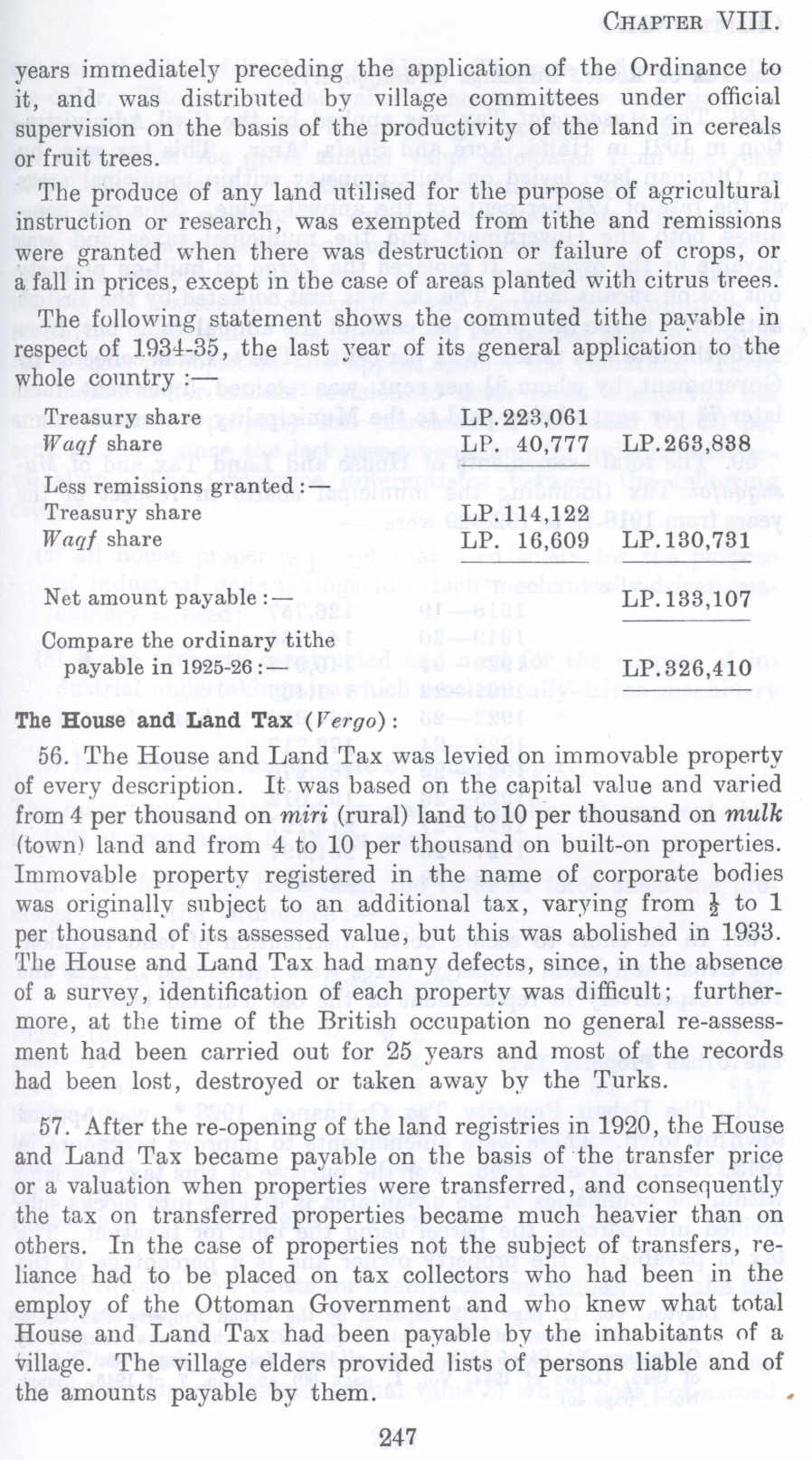

The following statement shows the commuted tithe payable in respect of 1934-35, the last year of its general application to the whole country :-

Treasury share Waqf share

LP.223,061

LP. 40,777 LP.263,888

Less remissions granted: Treasury share

Waqf share

LP.114,122

LP. 16,609 LP.130,731

Net amount payable: Compare the ordinary tithe payable in 1925-26 :-

LP.133,107

LP.326,410

The House and Land Tax (Vergo) :

56. The House and Land Tax was levied on immovable property of every description. It was based on the capital value and varied from 4 per thousand on miri (rural) land to 10 per thousand on mulk (town) land and from 4 to 10 per thousand on built-on properties. Immovable property registered in the name of corporate bodies was originally subject to an additional tax, varying from ~ to 1 per thousand of its assessed value, but this was abolished in 1933. The House and Land Tax had many defects, since, in the absence of a survey, identification of each property was difficult; furthermore, at the time of the British occupation no general re-assessment had been carried out for 25 years and most of the records bad been lost, destroyed or taken away by the Turks.

57. After the re-opening of the land registries in 1920, the House and Land Tax became payable on the basis of the transfer price or a valuation when properties were transferred, and consequently the tax on transferred properties became much heavier than on others. In the case of properties not the subject of transfers, reliance had to be placed on tax collectors who had been in the employ of the Ottoman Government and who knew what total House and Land Tax had been payable by the inhabitants of a village. The village elders provided lists of persons liable and of the amounts payable by them.

Page 247