| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

Real Estate Taxes in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume I - Page 248. Chapter VIII: Land: Section 4: System of Land Taxation: Tax of Roofed buildings, The Urban Property Tax |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

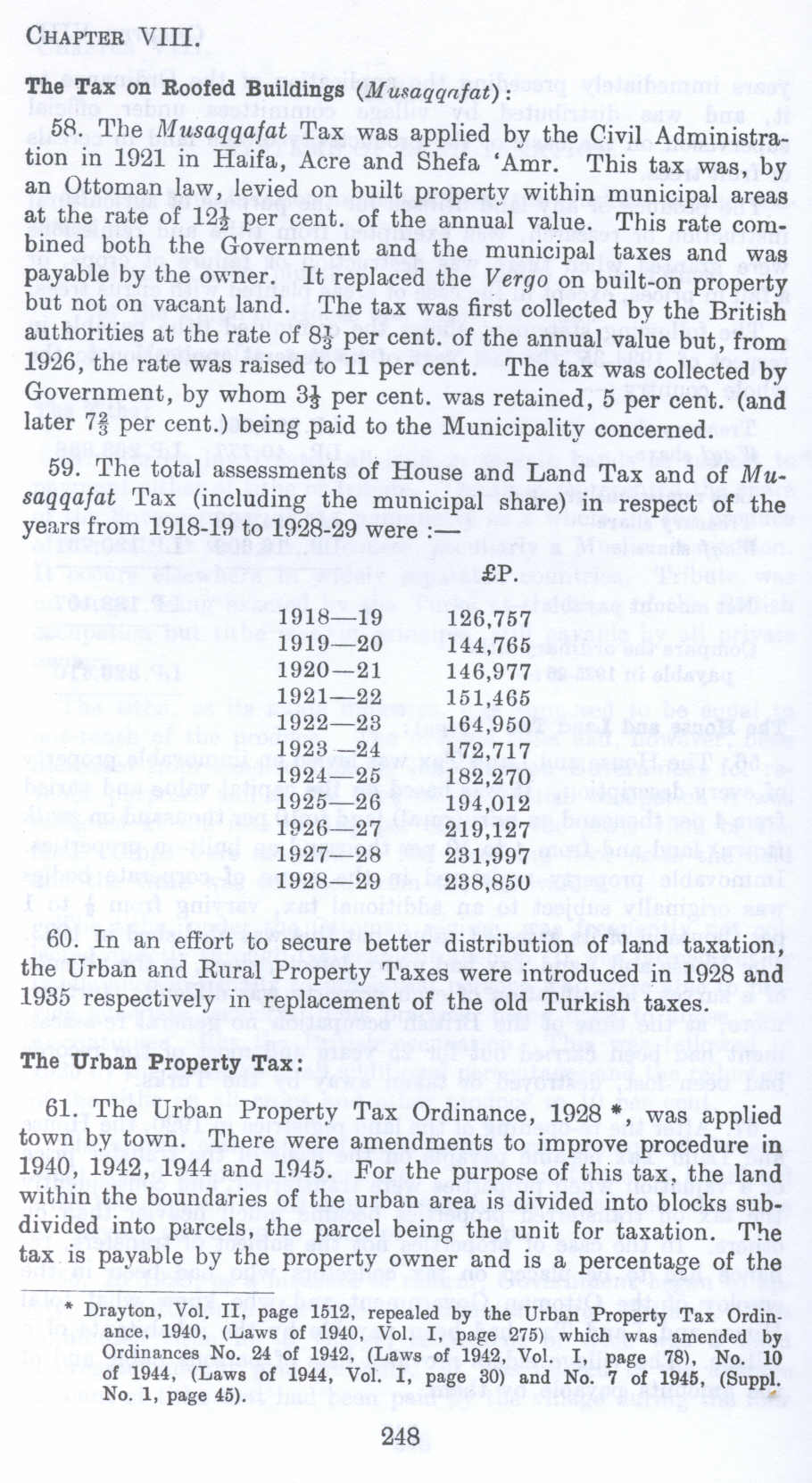

The Tax on Roofed Buildings (Musaqqfat):

58 The Musaqqafat Tax was applied by the Civil Administration in l921 in Haifa, Acre and Shefa 'Amr. This tax was, by an Ottoman law, levied on built property within municipal areas at the rate of 12! per cent. of the annual value. This rate combined both the Government and the municipal taxes and was payable by the owner. It replaced the Vergo on built-on property but not on vacant land. The tax was first collected by the British authorities at the rate of 8! per cent. of the annual value but, from 1926, the rate was raised to 11 per cent. The tax was collected by Government, by whom 3 1/2 per cent. was retained, 5 per cent. (and later 7 2/3 per cent.) being paid to the Municipality concerned.

59. The total assessments of House and Land Tax and of Musaqqafat Tax (including the municipal share) in respect of the years from 1918-19 to 1928-29 were :-

1918-19 1919-20 1920-21 1921-22 1922-23 1923 -24 1924-25 1925-26 1926-27 1927-28 1928-29

£P. 126,757 144,765 146,977 151,465 164,950 172,717 182,270 194,012 219,127 231,997 238,850

60. In an effort to secure better distribution of land taxation, the Urban and Rural Property Taxes were introduced in 1928 and 1935 respectively in replacement of the old Turkish taxes.

The Urban Property Tax:

61. The Urban Property Tax Ordinance, 1928 *, was applied town by town. There were amendments to improve procedure in 1940, 1942, 1944 and 1945. For the purpose of this tax, the land within the boundaries of the urban area is divided into blocks subdivided into parcels, the parcel being the unit for taxation. The tax is payable by the property owner and is a percentage of the

___________________

* Drayton, Vol. TI, page 1512, repealed by the Urban Property Tax Ordinance. 1940, (Laws of 1940, Vol. I, page 275) which was amended by Ordinances No. 24 of 1942. (Laws of 1942, Vol. I, page 78), No. 10 of 1944, (Laws of 1944, Vol. I, page 80) and No. 7 of 1945, (Suppl. No. 1, page 45). ..

Page 248