| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 249. Chapter VIII: Land: Section 4: System of Land Taxation |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

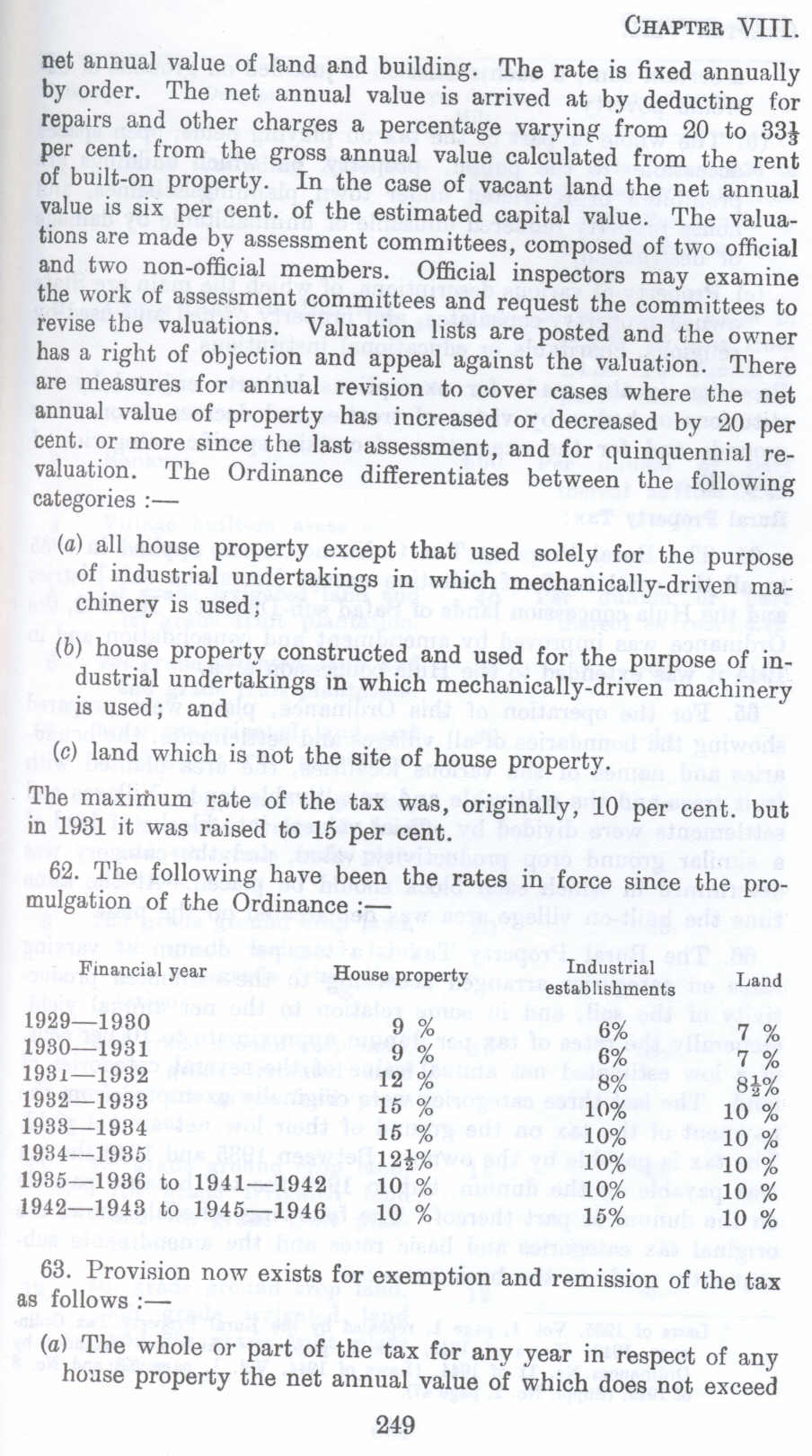

net annual value of land and building. The rate is fixed annually by order. The net. annual value is arrived at by deducting for repairs and other charges a percentage varying from 20 to 33! per cent. from the gross annual value calculated from the rent of built-on property. In the case of vacant land the net annual value is six per cent. of the estimated capital value. The valuations are made by assessment committees, composed of two official and two non-official members. Official inspectors may examine the work of assessment committees and request the committees to revise the valuations. Valuation lists are posted and the owner has a right of objection and appeal against the valuation. There are measures for annual revision to cover cases where the net annual value of property has increased or decreased by 20 per cent. or more since the last assessment, and for quinquennial revaluation. The Ordinance differentiates between the following categories :-

(a) all house property except that used solely for the purpose of industrial undertakings in which mechanically-driven machinery is used;

(b) house property constructed and used for the purpose of industrial undertakings in which mechanically-driven machinery is used; and

(c) land which is not the site of house property.

The maximum rate of the tax was, originally, 10 per cent. but in 1931 it was raised to 15 per cent.

62. The following have been the rates in force since the promulgation of the Ordinance :-

Financial year House property Industrial Land

establishments

1929-1930 9 % 6% 7 %

1930-1931 9 % 6% 7 %

1931-1932 12 % 8% 8!%

1932-1933 15 % 10% 10 %

1983-1934 15 % 10% 10 %

1934-1935 12!% 10% 10 %

1935-1936 to 1941-1942 10 % 10% 10 %

1942-1948 to 1945-1946 10 % 15% 10 % 63. Provision now exists for exemption and remission of the tax as follows:-

(a) The whole or part of the tax for any year in respect of any house property the net annual value of which does not exceed

Page 249