| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

Rural Real Estate Taxes in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume I - Page 250. Chapter VIII: Land: Section 4: System of Land Taxation: Rural Property Tax |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

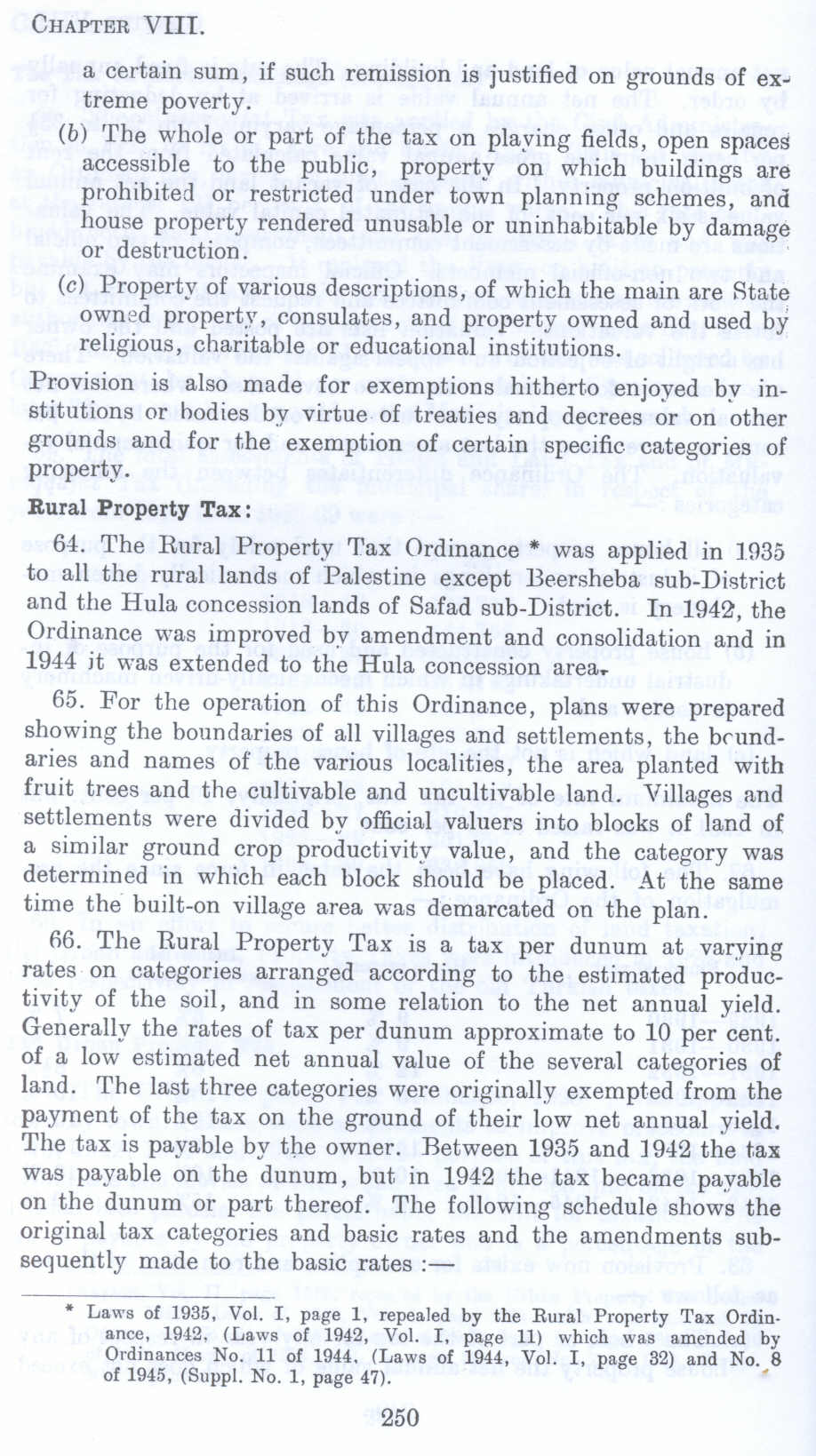

a certain sum, if such remission is justified on grounds of extreme poverty.

(b) 'The whole or part of the tax on playing fields, open spaces accessible to the public, property on which buildings are prohibited or restricted under town planning schemes, and house property rendered unusable or uninhabitable by damage or destruction.

(c) Property of various descriptions, of which the main are State owned property , consulates, and property owned and used by religious, charitable or educational institutions.

Provision is also made for exemptions hitherto enjoyed by institutions or bodies bv virtue of treaties and decrees or on other grounds and for the - exemption of certain specific categories of property.

Rural Property Tax:

64. The Rural Property Tax Ordinance * was applied in 1035 to all the rural lands of Palestine except Beersheba sub-District and the Hula concession lands of Safad sub-District. In 1942, the Ordinance was improved by amendment and consolidation and in 1944 it was extended to the Hula concession area.

65. For the operation of this Ordinance, plans were prepared showing the boundaries of all villages and settlements, the boundaries and names of the various localities, the area planted with fruit trees and the cultivable and uncultivable land. Villages and settlements were divided by official valuers into blocks of land of a similar ground crop productivity value, and the category was determined in which each block should be placed. At the same time the built-on village area was demarcated on the plan.

66. The Rural Property Tax is a tax per dunum at varying rates on categories arranged according to the estimated productivity of the soil, and in some relation to the net annual yield. Generally the rates of tax per dunum approximate to 10 per cent. of a low estimated net annual value of the several categories of land. The last three categories were originally exempted from the payment of the tax on the ground of their low net annual yield. The tax is payable by the owner. Between 1935 and 1942 the tax was payable on the dunum, but in 1942 the tax became payable on the dunum or part thereof. The following schedule shows the original tax categories and basic rates and the amendments subsequently made to the basic rates :-

________________________

* Laws or 1935, Vol. I, page L, repealed by the Rural Property Tax Ordinance, 1942, (Laws of 1942, Vol. I, page 11) which was amended by Ordinances No. 11 of 1944, (Laws of 1944, Vol. I, page 32) and No. 8 of 1945, (Suppl. No. 1, page 47). *

Page 250