| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

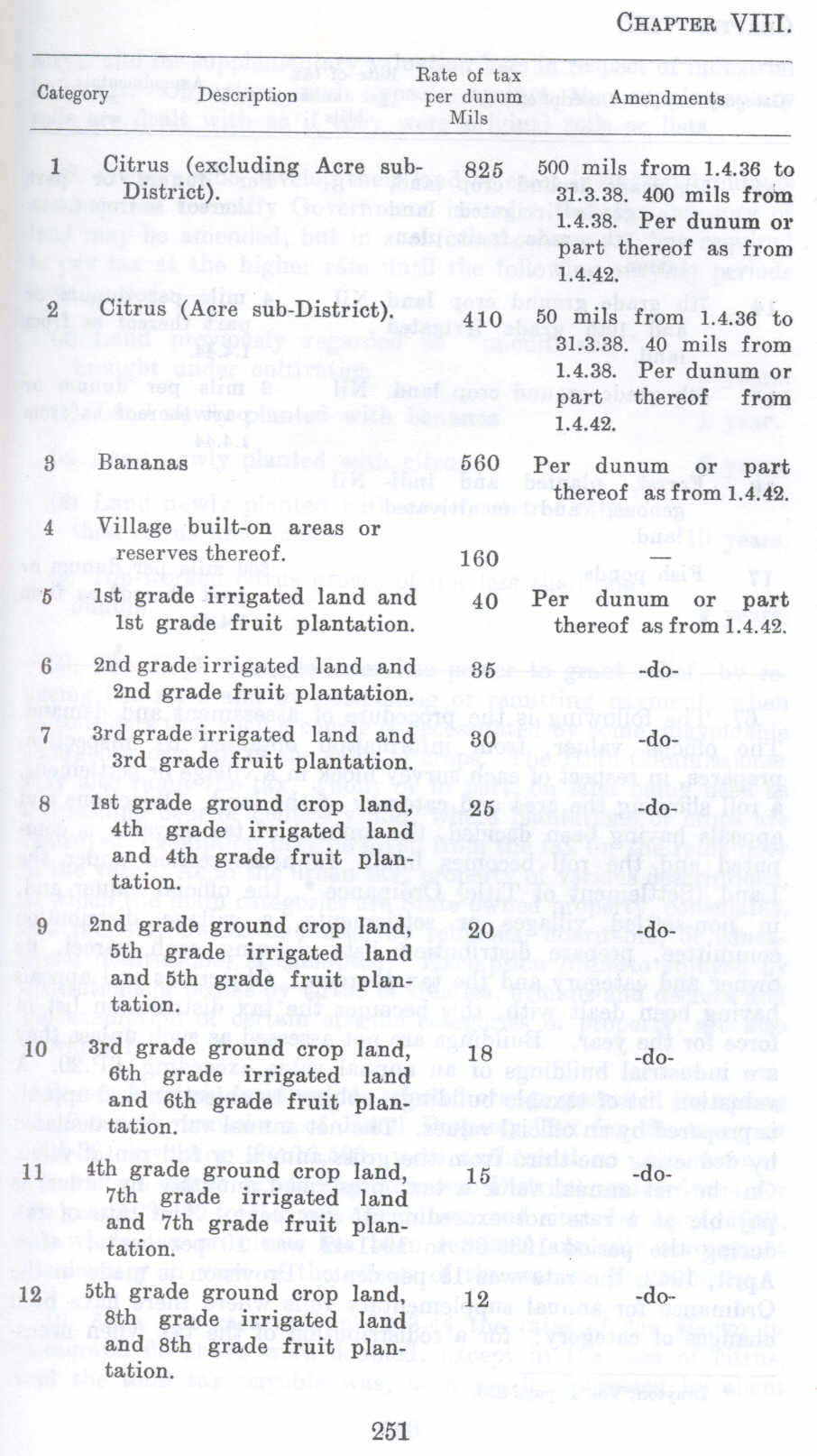

A table Showing Original Tax Land Categories And Basic Rates in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume I - Page 251. Chapter VIII: Land: Section 4: System of Land Taxation |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

Category

Description

Rate of tax per dunum Mils

Amendments

Citrus (excluding Acre sub District).

825 500 mils from 1.4.36 to 31.3.38. 400 mi1s from 1.4.38. Per dunum or part thereof as from 1.4.42.

410 50 mils from 1.4.36 to 31.3.38. 40 mils from 1.4.38. Per dunum or part thereof from 1.4.42.

2 Citrus (Acre sub-District).

Bananas 560 Per dun um or part

thereof as from 1.4.42.

Village built-on areas or

reserves thereof. 160

1st grade irrigated land and 40 Per dun um or part

1st grade fruit plantation. thereof as from 1.4.42.

2nd grade irrigated land and 85 -do-

2nd grade fruit plantation.

3rd grade irrigated land and so -do-

3rd grade fruit plantation.

Jst grade ground crop land, 25 -do-

4th grade irrigated land

and 4th grade fruit plantation -

2nd grade ground crop land, 20 -do-

5th grade irrigated land

and 5th grade fruit plantation

10 ard grade ground crop land, 18 -do-

6th grade irrigated land

and 6th grade fruit

II tth grade ground crop land, 15 -do-

7th grade irrigated land

and 7th grade fruit plantation

12 5th grade ground crop land, 12 -do-

8th grade irrigated land

and 8th grade fruit plantation.

251

CHAPTER VIII.

Category

Description

Rate of tax per dunum :Mils

Amendments

r.-13• 6th grade ground crop land,

-atb grade irrigated land and 9th grade fruit plantation.

14 7th grade ground crop land. Nil

and 10th grade irrigated land.

8

Per dunum or part thereof as from 1.4.42.

4 mils per dun urn or part thereof as from 1.4.44.

15 • 8th grade ground crop land. Nil

2 mils per dunum or part thereof as from 1.4.44.

••16 Forest, planted and indi- Nil

genous, and uncultivated land.

17

Fish ponds.

560 mils per dunum or pa.rt thereof as from 1.4.44.

67. Tha following is the procedure of assessment and demand. The official valuer, from information obtained by inspection, prepares, in respect. of each survey block in a village or settlement, a roll showing the area and category of the land. Objections and appeals having been decided, the amount of tax payable is computed and the roll becomes final. In areas settled under the Land (Settlement of Title) Ordinance ", the official valuer and, in non-settled villages or settlements, a village distribution committee, prepare distribution lists showing each parcel, its owner and category and the tax thereon. Objections and appeals having been dealt with, this becomes the tax distribution list in force for the year. Buildings are not assessed as such unless they are industrial buildings of an annual value exceeding £P.20. A valuation list of taxable buildings, subject to objection and appeal, is prepared by an official valuer. The net annual value is calculated by deducting one-third from the gross annual or full rental value. On the net annual value a tax, prescribed annually by order, is payable at a rate not exceeding 15 per• cent. '!'he rate of tax during the period 1935-36 to 1941-42 was 10 per cent.: after April, 1!)42, the rate was 15 per cent. Provision is made in the Ordinance for annual supplementary rolls where there have been changes of category; for a redistribution of the tax when necessary

* Drayton, Vol. I, page 853,

Page 252