| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 253 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

necessary: and for supplementary valuation lists in respect of industrial buildings. Objections and appeals against the supplementary rolls are dealt with as if they were original rolls or lists.

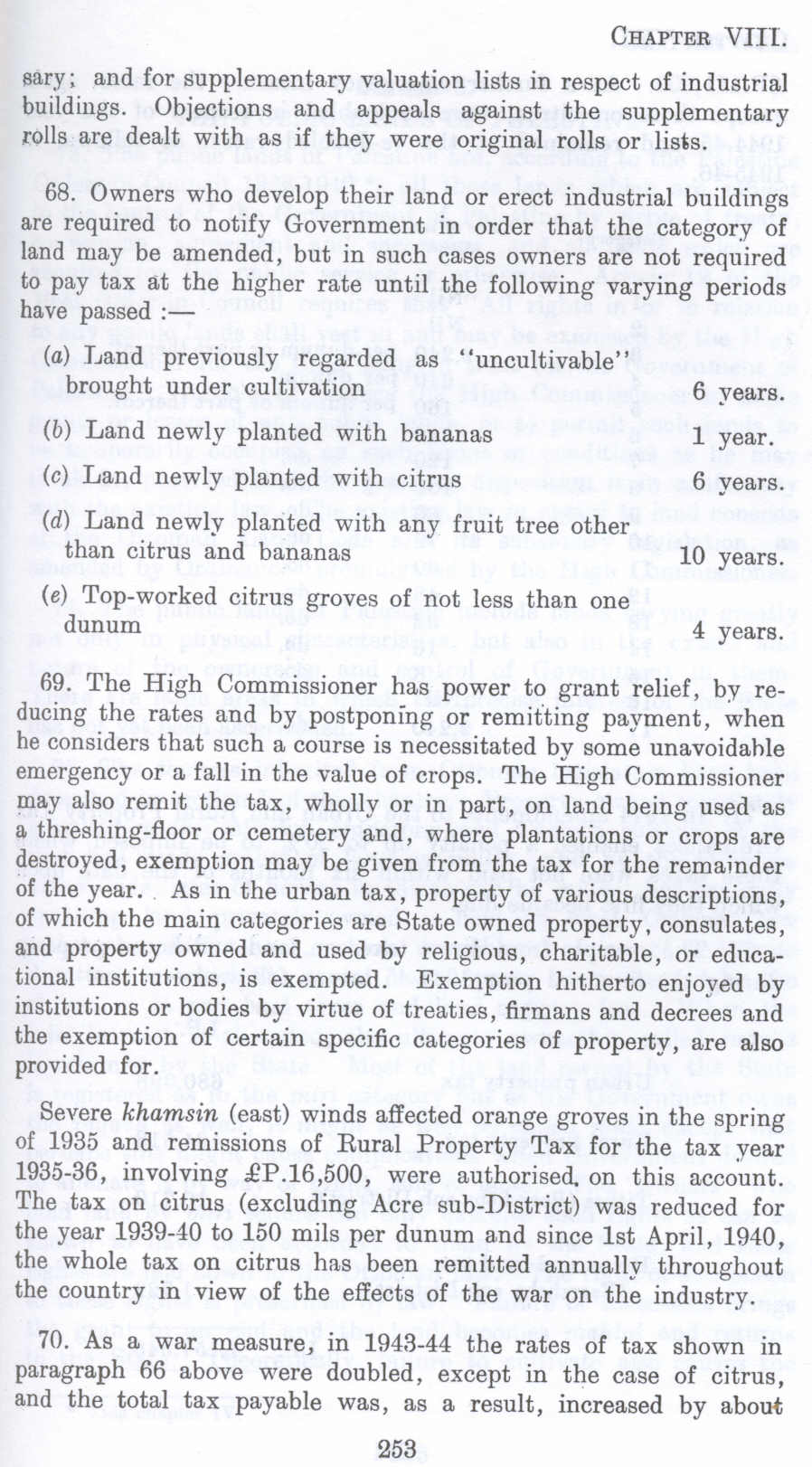

68. Owners who develop their land or erect industrial buildings are required to notify Government in order that the category of land may be amended, but in such cases owners are not required to pay tax at the higher rate until the following varying periods have passed :-

(a) Land previously regarded as "uncultivable" brought under cultivation

(b) Land newly planted with bananas

6 years.

1 year.

(c) Land newly planted with citrus

(d) Land newly planted with any fruit tree other than citrus and bananas

(e) Top-worked citrus groves of not less than one dun um

6 years.

10 years.

4 years.

69. The High Commissioner has power to grant relief, by reducing the rates and by postponing or remitting payment, when he considers that such a course is necessitated by some unavoidable emergency or a fall in the value of crops. The High Commissioner may also remit the tax, wholly or in part, on land being used as a threshing-floor or cemetery and, where plantations or crops are destroyed, exemption may be given from the tax for the remainder of the year. As in the urban tax, property of various descriptions, of which the main categories are State owned property, consulates, and property owned and used by religious, charitable, or educational institutions, is exempted. Exemption hitherto enjoyed by institutions or bodies by virtue of treaties, firm ans and decrees and the exemption of certain specific categories of property, are also provided for.

Severe khamsin (east) winds affected orange groves in the spring of 1935 and remissions of Rural Property Tax for the tax year 1935-36, involving £P.16,500, were authorised. on this account. The tax on citrus (excluding Acre sub-District) was reduced for the year 1939-40 to 150 mils per dunum and since 1st April, 1940, the whole tax on citrus has been remitted annually throughout the country in view of the effects of the war on the industry.

70. As a war measure, in 1943-44 the rates of tax shown in paragraph 66 above were doubled, except in the case of citrus, and the total tax payable was, as a result, increased by about

Page 253