| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 254 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

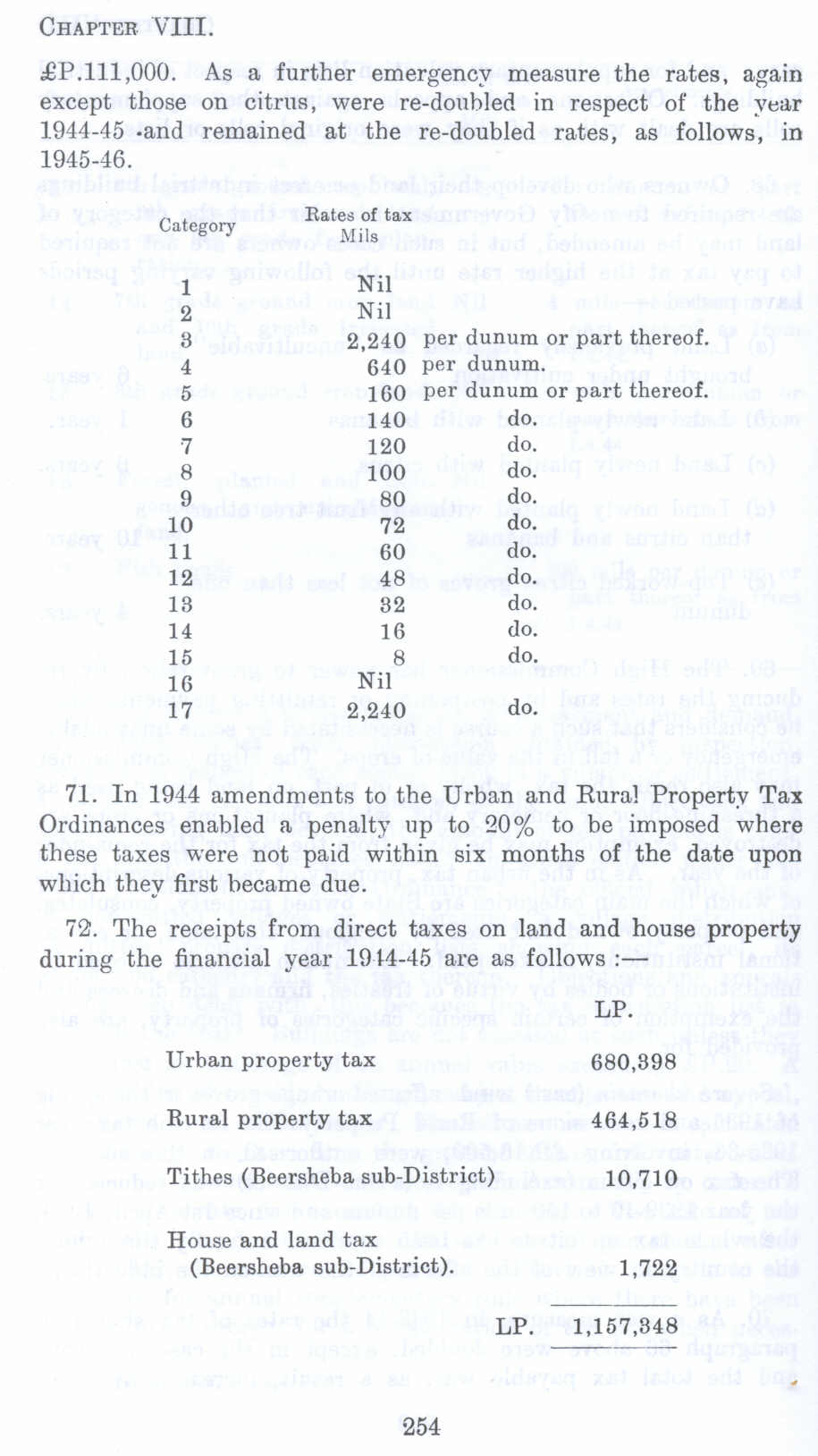

£P.lll,000. As a further emergency measure the rates, again except those on citrus, were re-doubled in respect of the year 1944-45 .and remained at the re-doubled rates, as follows, in 1945-46.

Category Rated of tax

1 Nil

1 Nil

2 Nil

3 2,240 per dunum or part thereof.

4 640 per dunum.

5 IGO per dun um or part thereof.

6 140 do.

7 120 do.

8 100 do.

9 80 do.

10 72 do.

11 60 do.

12 48 do.

18 32 do.

14 16 do.

15 8 do.

16 Nil

17 2,240 do.

71. In 1944 amendments to the Urban and Rural Property Tax Ordinances enabled a penalty up to 20% to be imposed where these taxes were not paid within six months of the date upon which they first became due.

72. The receipts from direct taxes on land and house property during the financial year HJ 14-45 are as follows :-

LP.

Urban property tax 680,398

Rural property tax 464,518

Tithes (Beersheba sub-District) 10,710

House and land tax

(Beersheba sub-District). 1,722

LP. 1,157,348

Page 254