| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 367 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

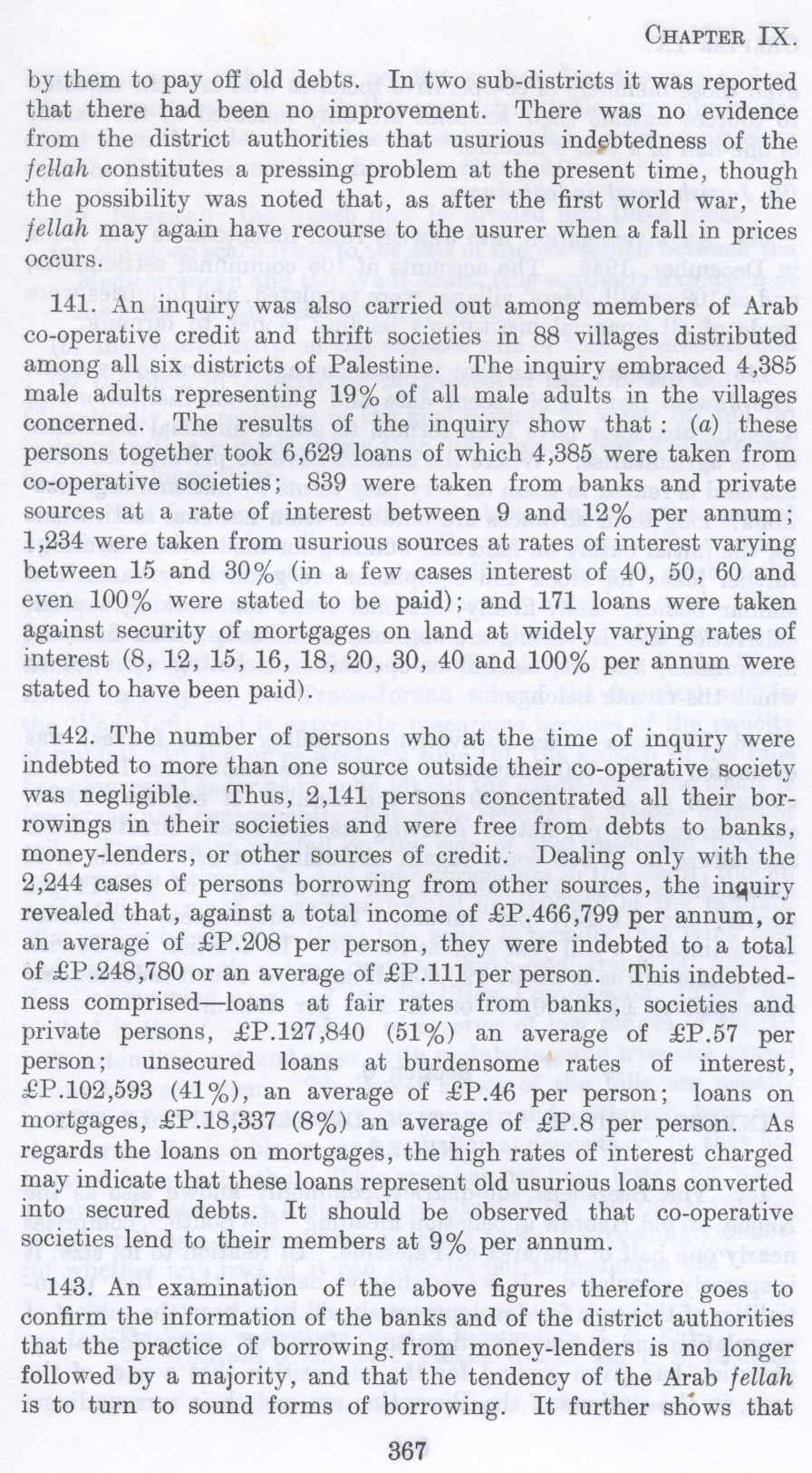

by them to pay off old debts. In two sub-districts it was reported that there had been no improvement. There was no evidence from the district authorities that usurious indebtedness of the fellah. constitutes a pressing problem at the present time, though the possibility was noted that, as after the first world war, the fellah may again have recourse to the usurer when a fall in prices occurs.

141. An inquiry was also carried out among members of Arab co-operative credit and thrift societies in 88 villages distributed among all six districts of Palestine. The inquiry embraced 4,385 male adults representing 19% of all male adults in the villages concerned. The results of the inquiry show that : (a) these persons together took 6,629 loans of which 4,385 were taken from co-operative societies; 839 were taken from banks and private sources at a rate of interest between 9 and 12% per annum; 1,234 were taken from usurious sources at rates of interest varying between 15 and 30% (in a few cases interest of 40, 50, 60 and even 100% were stated to be paid); and 171 loans were taken against security of mortgages on land at widely varying rates of interest (8, 12, 15, 16, 18, 20, 30, 40 and 100% per annum were stated to have been paid).

142. The number of persons who at the time of inquiry were indebted to more than one source outside their co-operative society was negligible. Thus, 2,141 persons concentrated all their borrowings in their societies and were free from debts to banks, money-lenders, or other sources of credit. Dealing only with the 2 ,244 cases of persons borrowing from other sources, the inquiry revealed that, against a total income of £P.466,799 per annum, or an average of £P.208 per person, they were indebted to a total of £P.248,780 or an average of £P.lll per person. This indebtedness comprised-loans at fair rates from banks, societies and private persons, £P.127,840 (51%) an average of £P.57 per person; unsecured loans at burdensome rates of interest, £P.102,593 (41%), an average of £P.46 per person; loans on mortgages, £P.18,337 (8%) an average of £P.8 per person. As regards the loans on mortgages, the high rates of interest charged may indicate that these loans represent old usurious loans converted into seemed debts. It should be observed that co-operative societies lend to their members at 9% per annum.

143. An examination of the above figures therefore goes to confirm the information of the banks and of the district authorities that the practice of borrowing. from money-lenders is no longer followed by a majority, and that the tendency of the Arab fellah is to turn to sound forms of borrowing. It further shows that

Page 367