| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

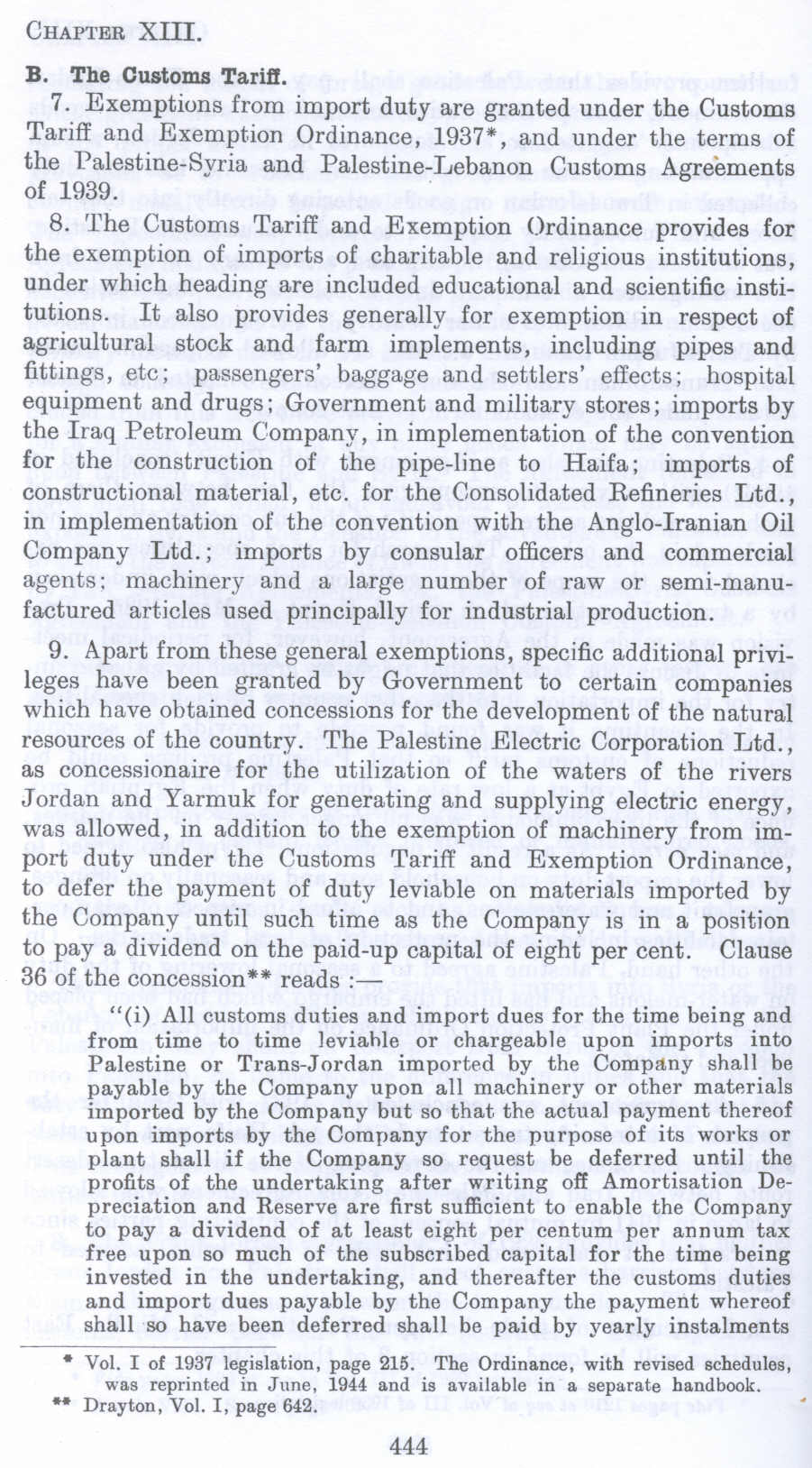

Customs and Tariffs in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume I - Page 444. Chapter XIII: Trade And Industry: Section 1: Trade Agreements, The Customs Tariff and Excise Duties |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

B. The Customs Tariff

7. Exemptions from import duty are granted under the Customs Tariff and Exemption Ordinance, 1937*, and under the terms of the Palestine-Syria and Palestine-Lebanon Customs Agreements of 1939.

8. The Customs Tariff and Exemption Ordinance provides for the exemption of imports of charitable and religious institutions, under which heading are included educational and scientific institutions. It also provides generally for exemption in respect of agricultural stock and farm implements, including pipes and fittings, etc; passengers' baggage and settlers' effects; hospital equipment and drugs; Government and military stores; imports by the Iraq Petroleum Company, in implementation of the convention for the construction of the pipe-line to Haifa; imports of constructional material, etc. for the Consolidated Refineries Ltd., in implementation of the convention with the Anglo-Iranian Oil Company Ltd.; imports by consular officers and commercial agents: machinery and a large number of raw or semi-manufactured articles used principally for industrial production.

9. Apart from these general exemptions, specific additional privileges have been granted by Government to certain companies which have obtained concessions for the development of the natural resources of the country. The Palestine Electric Corporation Ltd., as concessionaire for the utilization of the waters of the rivers Jordan and Yarmuk for generating and supplying electric energy, was allowed, in addition to the exemption of machinery from import duty under the Customs Tariff and Exemption Ordinance, to defer the payment of duty leviable on materials imported by the Company until such time as the Company is in a position to pay a dividend on the paid-up capital of eight per cent. Clause 36 of the concession ** reads :-

“(i) All customs duties and import dues for the time being and from time to time leviahle or chargeable upon imports into Palestine or Trans-Jordan imported by the Company shall be payable by the Company upon all machinery or other materials imported by the Company but so that the actual payment thereof upon imports by the Company for the purpose of its works or plant shall if the Company so request be deferred until the profits of the undertaking after writing off Amortisation Depreciation and Reserve are first sufficient to enable the Company to pay a dividend of at least eight per centum per annum tax free upon so much of the subscribed capital for the time being invested in the undertaking, and thereafter the customs duties and import dues payable by the Company the payment whereof shall so have been deferred shall be paid by yearly installments

__________________________________

* Vol. I of 1937 legislation, page 215. The Ordinance, with revised schedules, wee reprinted in June, 1944 and is available in a separate handbook .

** Drayton, Vol. I, page 642.

Page 444