| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 445 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

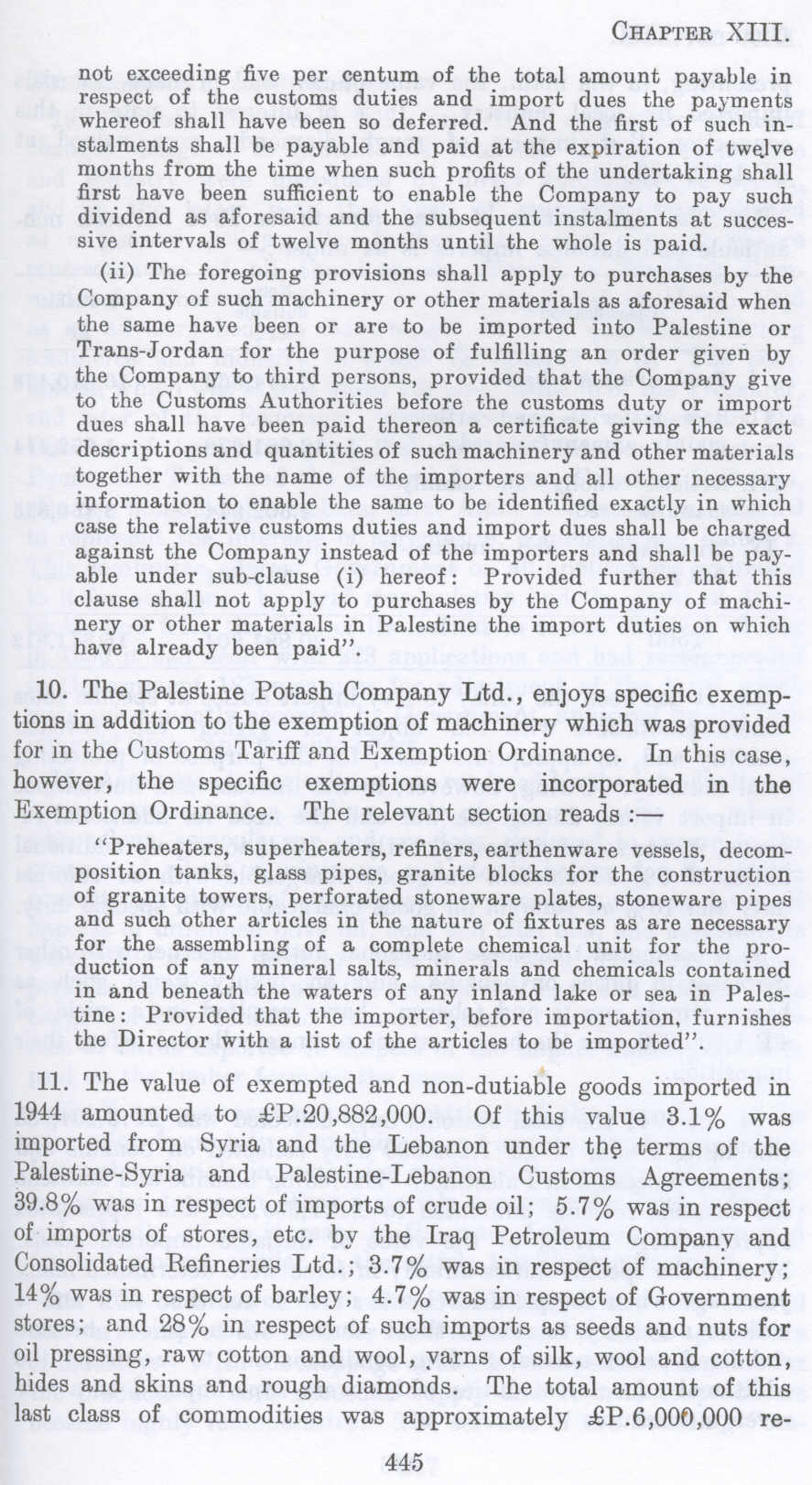

not exceeding five per centum of the total amount payable in respect of the customs duties and import dues the payments whereof shall have been so deferred. And the first of such installments shall be payable and paid at the expiration of twelve months from the time when such profits of the undertaking shall first have been sufficient to enable the Company to pay such dividend as aforesaid and the subsequent installments at successive intervals of twelve months until the whole is paid.

(ii) The foregoing provisions shall apply to purchases by the Company of such machinery or other materials as aforesaid when the same have been or are to be imported into Palestine or Trans-Jordan for the purpose of fulfilling an order given by the Company to third persons, provided that the Company give to the Customs Authorities before the customs duty or import dues shall have been paid thereon a. certificate giving the exact descriptions and quantities of such machinery and other materials together with the name of the importers and all other necessary information to enable the same to be identified exactly in which case the relative customs duties and import dues shall be charged against the Company instead of the importers and shall be payable under sub-clause (i) hereof: Provided further that this clause shall not apply to purchases by the Company of machinery or other materials in Palestine the import duties on which have already been paid".

10. The Palestine Potash Company Ltd., enjoys specific exemptions in addition to the exemption of machinery which was provided for in the Customs Tariff and Exemption Ordinance. In this case, however, the specific exemptions were incorporated in the Exemption Ordinance. The relevant section reads :-

"Preheaters, superheaters, refiners, earthenware vessels, decomposition tanks, glass pipes, granite blocks for the construction of granite towers, perforated stoneware plates, stoneware pipes and such other articles in the nature of fixtures as are necessary for the assembling of a complete chemical unit for the production of any mineral salts, minerals and chemicals contained in and beneath the waters of any inland lake or sea in Palestine: Provided that the importer, before importation, furnishes the Director with a list of the articles to be imported".

11. The value of exempted and non-dutiable goods imported in 1944 amounted to £P.20,882,000. Of this value 3.1 % was imported from Syria and the Lebanon under the terms of the Palestine-Syria and Palestine-Lebanon Customs Agreements; 39.8% was in respect of imports of crude oil; 5.7% was in respect of imports of stores, etc. by the Iraq Petroleum Company and Consolidated Refineries Ltd.; 3.7% was in respect of machinery; 14% was in respect of barley; 4. 7% was in respect of Government stores; and 28% in respect of such imports as seeds and nuts for oil pressing, raw cotton and wool, yarns of silk, wool and cotton, bides and skins and rough diamonds. The total amount of this last class of commodities was approximately £P.6,000,000 re-

Page 445