| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 446 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

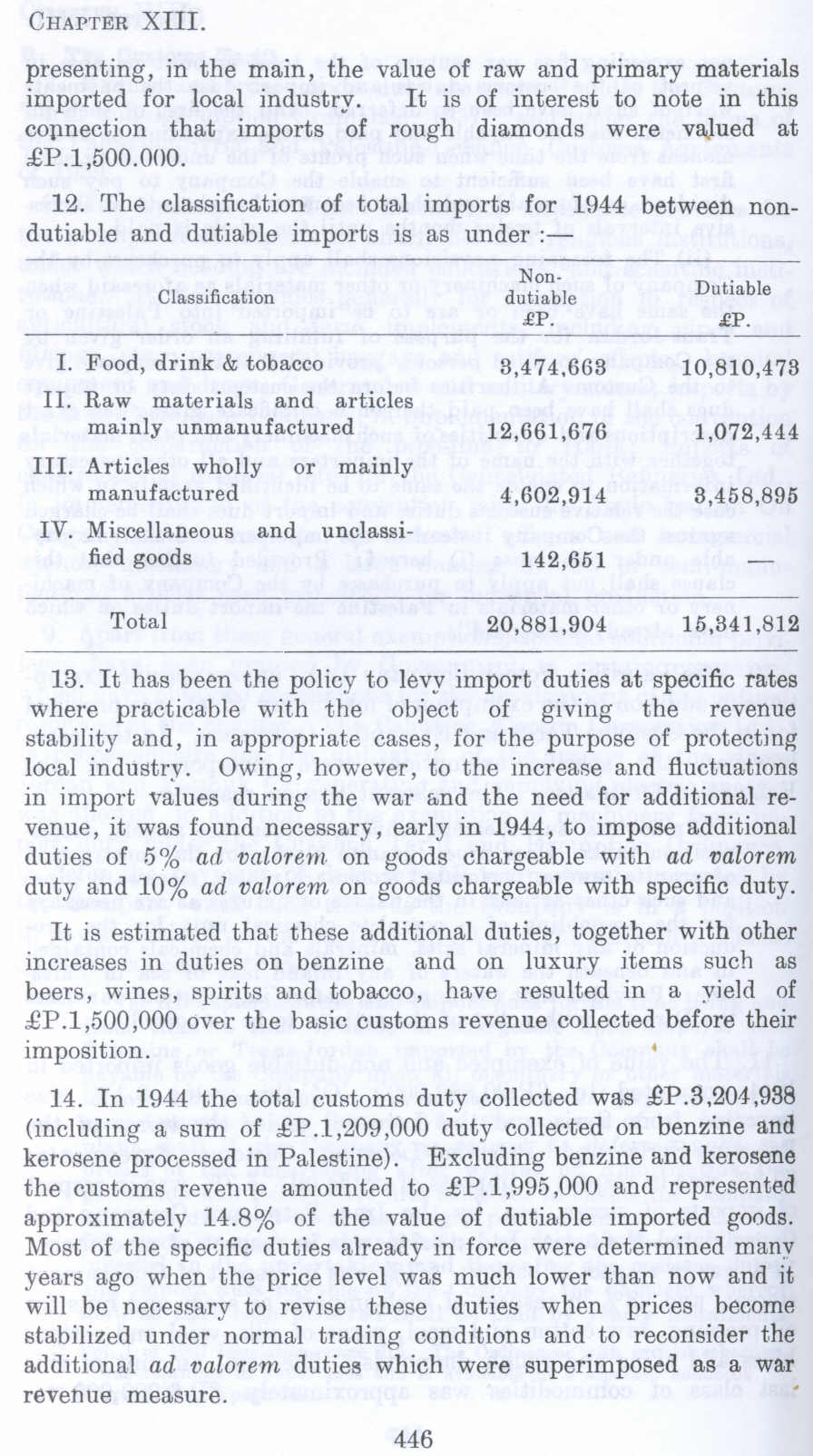

presenting, in the main, the value of raw and primary materials imported for local industry. It is of interest to note in this connection that imports of rough diamonds were valued at £P.l,500.000.

12. The classification of total imports for 1944 between nondutiable and dutiable imports is as under :-

Non- Dutiable

Classification dutiable

£P. £P.

I. Food, drink & tobacco 3,474,663 10,810,473

II. Raw materials and articles

mainly unmanufactured 12,661,676 1,072,444

III. Articles wholly or mainly

manufactured 4,602,914 3,458,895

IV. Miscellaneous and unclassified goods 142,661

Total 20,881,904 16,341,812

13. It has been the policy to levy import duties at specific rates where practicable with the object of giving the revenue stability and, in appropriate cases, for the purpose of protecting local industry. Owing, however, to the increase and fluctuations in import values during the war and the need for additional revenue, it was found necessary, early in 1944, to impose additional duties of 5% ad valorem on goods chargeable with ad valorem duty and 10% ad valorem on goods chargeable with specific duty.

It is estimated that these additional duties, together with other increases in duties on benzine and on luxury items such as beers, wines, spirits and tobacco, have resulted in a yield of £P.l,500,000 over the basic customs revenue collected before their imposition.

14. In 1944 the total customs duty collected was £P.3,204,938 (including a sum of £P.l,209,000 duty collected on benzine and kerosene processed in Palestine). Excluding benzine and kerosene the customs revenue amounted to £P.l,995,000 and represented approximately 14.8% of the value of dutiable imported goods. Most of the specific duties already in force were determined many years ago when the price level was much lower than now and it will be necessary to revise these duties when prices become stabilized under normal trading conditions and to reconsider the additional ad valo'rem duties which were superimposed as a war revenue measure.

Page 446