| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

Customs, Tariff and Excise Duties in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume I - Page 447. Chapter XIII: Trade And Industry: Section 1: Trade Agreements, : |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

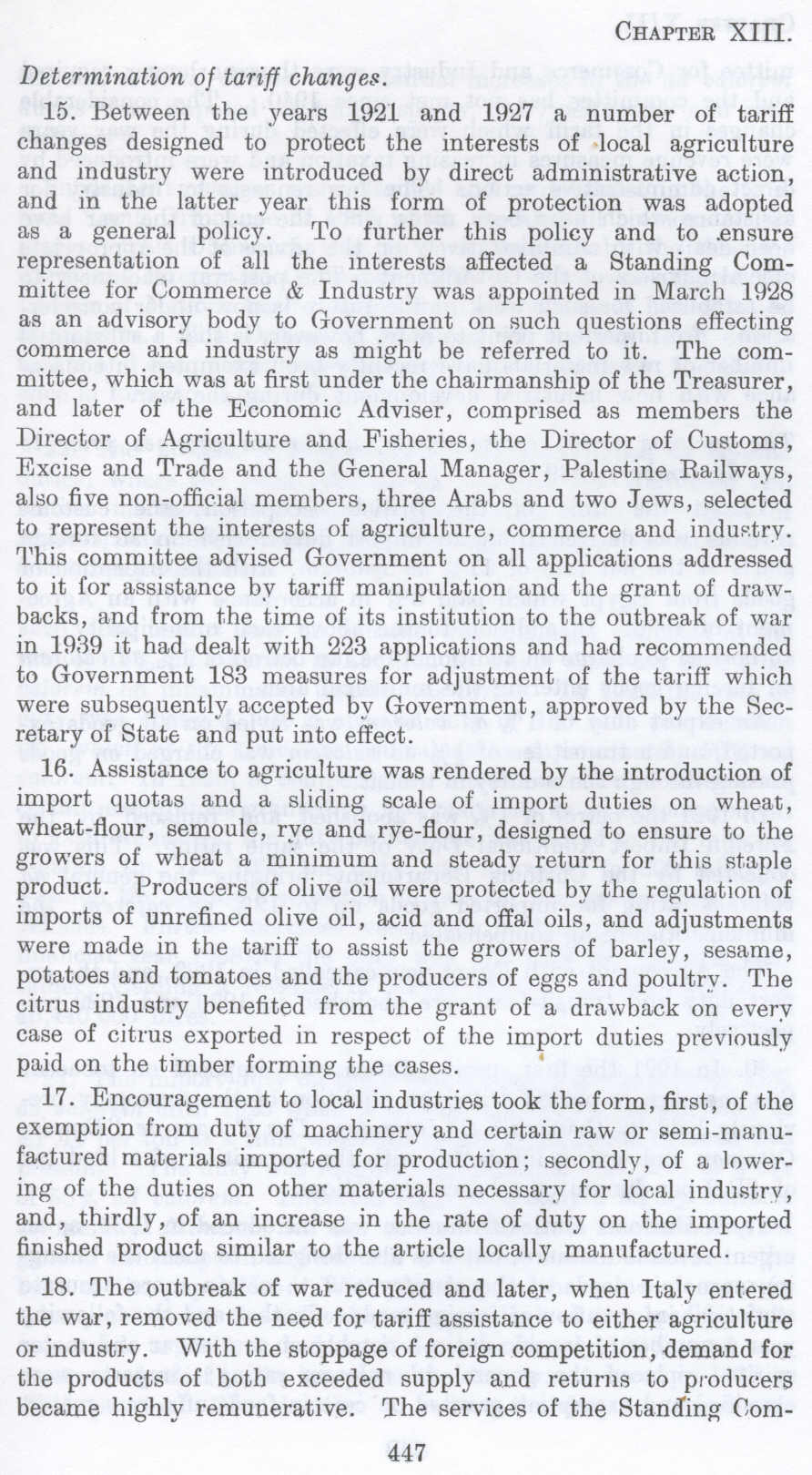

Determination of tariff changes.

15. Between the years 1921 and 1927 a number of tariff changes designed to protect the interests of local agriculture and industry were introduced by direct administrative action, and in the latter year this form of protection was adopted as a general policy. To further this policy and to .ensure representation of all the interests affected a Standing Committee for Commerce & Industry was appointed in March 1928 as an advisory body to Government on such questions effecting commerce and industry as might be referred to it. The committee, which was at first under the chairmanship of the Treasurer, and later of the Economic Adviser, comprised as members the Director of Agriculture and Fisheries, the Director of Customs, Excise and Trade and the General Manager, Palestine Railways, also five non-official members, three Arabs and two Jews, selected to represent the interests of agriculture, commerce and industry. This committee advised Government on all applications addressed to it for assistance by tariff manipulation and the grant of drawbacks, and from the time of its institution to the outbreak of war in Hl39 it had dealt with 223 applications and had recommended to Government 183 measures for adjustment of the tariff which were subsequently accepted by Government, approved by the Secretary of State and put into effect.

16. Assistance to agriculture was rendered by the introduction of import quotas and a sliding scale of import duties on wheat, wheat-flour, semoule, rye and rye-flour, designed to ensure to the growers of wheat a minimum and steady return for this staple product. Producers of olive oil were protected by the regulation of imports of unrefined olive oil, acid and offal oils, and adjustments were made in the tariff to assist the growers of barley, sesame, potatoes and tomatoes and the producers of eggs and poultry. The citrus industry benefited from the grant of a drawback on every case of citrus exported in respect of the import duties previously paid on the timber forming the cases.

17. Encouragement to local industries took the form, first, of the exemption from duty of machinery and certain raw or semi-manufactured materials imported for production; secondly, of a lowering of the duties on other materials necessary for local industry, and, thirdly, of an increase in the rate of duty on the imported finished product similar to the article locally manufactured.

18. The outbreak of war reduced and later, when Italy entered the war, removed the need for tariff assistance to either agriculture or industry. With the stoppage of foreign competition, demand for the products of both exceeded supply and returns to producers became highly remunerative. The services of the Standing Com-

Page 447