| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 448 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

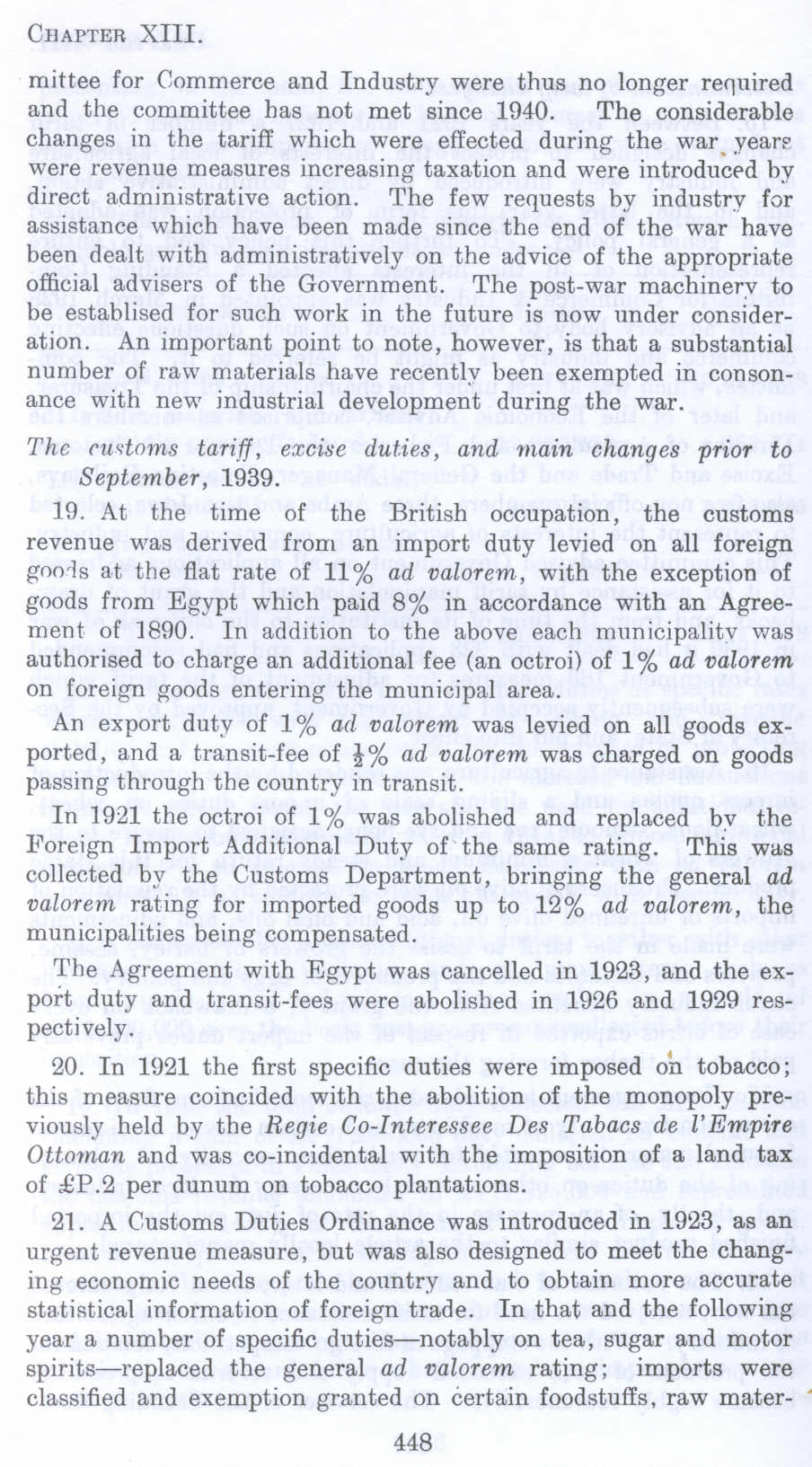

mittee for Commerce and Industry were thus no longer required and the committee has not met since 1940. The considerable changes in the tariff which were effected during the war years were revenue measures increasing taxation and were introduced by direct administrative action. The few requests by industry for assistance which have been made since the end of the war have been dealt with administratively on the advice of the appropriate official advisers of the Government. The post-war machinery to be established for such work in the future is now under consideration. An important point to note, however, is that a substantial number of raw materials have recently been exempted in consonance with new industrial development during the war.

The customs tariff, excise duties, and main changes prior to September, 1939.

19. At the time of the British occupation, the customs revenue was derived from an import duty levied on all foreign goods at the flat rate of 11 % ad valorem, with the exception of goods from Egypt which paid 8% in accordance with an Agreement of 1890. In addition to the above each municipality was authorised to charge an additional fee (an octroi) of 1% ad valorem on foreign goods entering the municipal area.

An export duty of 1 % ad valorem was levied on all goods exported, and a transit-fee of 1% ad valoreni was charged on goods passing through the country in transit.

In 1921 the octroi of 1 % was abolished and replaced by the Foreign Import Additional Duty of the same rating. This was collected by the Customs Department, bringing the general ad valorem rating for imported goods up to 1 1/2% ad valorem, the municipalities being compensated.

The Agreement with Egypt was cancelled in 1923, and the export duty and transit-fees were abolished in 1926 and 1929 respectively.

20. In 1921 the first specific duties were imposed on tobacco; this measure coincided with the abolition of the monopoly previously held by the Regie Co-Interessee Des Tabacs de l’Empire Ottoman and was co-incidental with the imposition of a land tax of £P.2 per dunum on tobacco plantations.

21. A Customs Duties Ordinance was introduced in 1923, as an urgent revenue measure, but was also designed to meet the changing economic needs of the country and to obtain more accurate statistical information of foreign trade. In that and the following year a number of specific duties-notably on tea, sugar and motor spirits-replaced the general ad valorem rating; imports were classified and exemption granted on certain foodstuffs, raw mater-

Page 448