| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 449 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

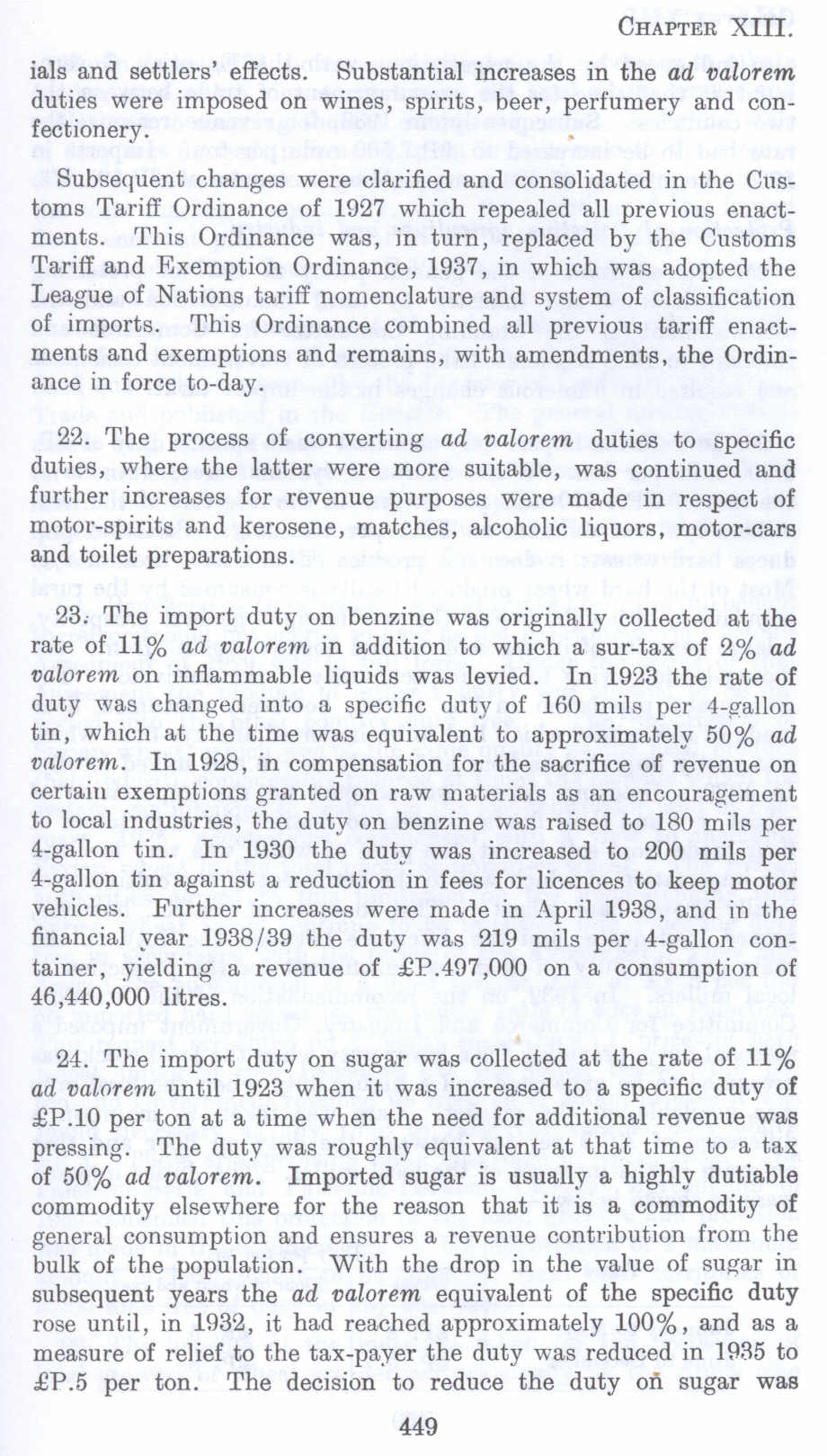

ials and settlers' effects. Substantial increases in the ad valorem duties were imposed on wines, spirits, beer, perfumery and confectionery.

Subsequent changes were clarified and consolidated in the Customs Tariff Ordinance of 1927 which repealed all previous enactments. This Ordinance was, in turn, replaced by the Customs Tariff and Exemption Ordinance, 1937, in which was adopted the League of Nations tariff nomenclature and system of classification of imports. This Ordinance combined all previous tariff enactments and exemptions and remains, with amendments, the Ordinance in force to-day.

22. The process of converting ad oalorem. duties to specific duties, where the latter were more suitable, was continued and further increases for revenue purposes were made in respect of motor-spirits and kerosene, matches, alcoholic liquors, motor-cars and toilet preparations.

23, The import duty on benzine was originally collected at the rate of 11 % ad valorem in addition to which a sur-tax of 2% ad valorem on inflammable liquids was levied. In 1923 the rate of duty was changed into a specific duty of 160 mils per 4-gallon tin, which at the time was equivalent to approximately 50% ad valorem. In 1928, in compensation for the sacrifice of revenue on certain exemptions granted on raw materials as an encouragement to local industries, the duty on benzine was raised to 180 mils per 4-gallon tin. In 1930 the duty was increased to 200 mils per 4-gallon tin against a reduction in fees for licences to keep motor vehicles. Further increases were made in April 1938, and in the financial year 1938/39 the duty was 219 mils per 4-gallon container, yielding a revenue of £P.497 ,000 on a consumption of 46,440,000 litres.

24. The import duty on sugar was collected at the rate of 11 % ad valnrem until 1923 when it was increased to a specific duty of £P .10 per ton at a time when the need for additional revenue was pressing. The duty was roughly equivalent at that time to a tax of 50 % ad valor em. Imported sugar is usually a highly dutiable commodity elsewhere for the reason that it is a commodity of general consumption and ensures a revenue contribution from the bulk of the population. With the drop in the value of sugar in subsequent years the ad valorem equivalent of the specific duty rose until, in 1932, it had reached approximately 100%, and as a measure of relief to the tax-payer the duty was reduced in 1935 to £P.5 per ton. The decision to reduce the duty on sugar was

Page 449