| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 450 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

also influenced by the negotiations with the Egyptian Government at that time for the encouragement of trade between the two countries. Subsequently, in 1938, for revenue reasons, the rate bad to be increased to £P.7.500 mils per ton. Imports in 1939 amounted to 27 ,682 tons, yielding a revenue of £P.191,273.

Protection of Palestine agriculture and industry.

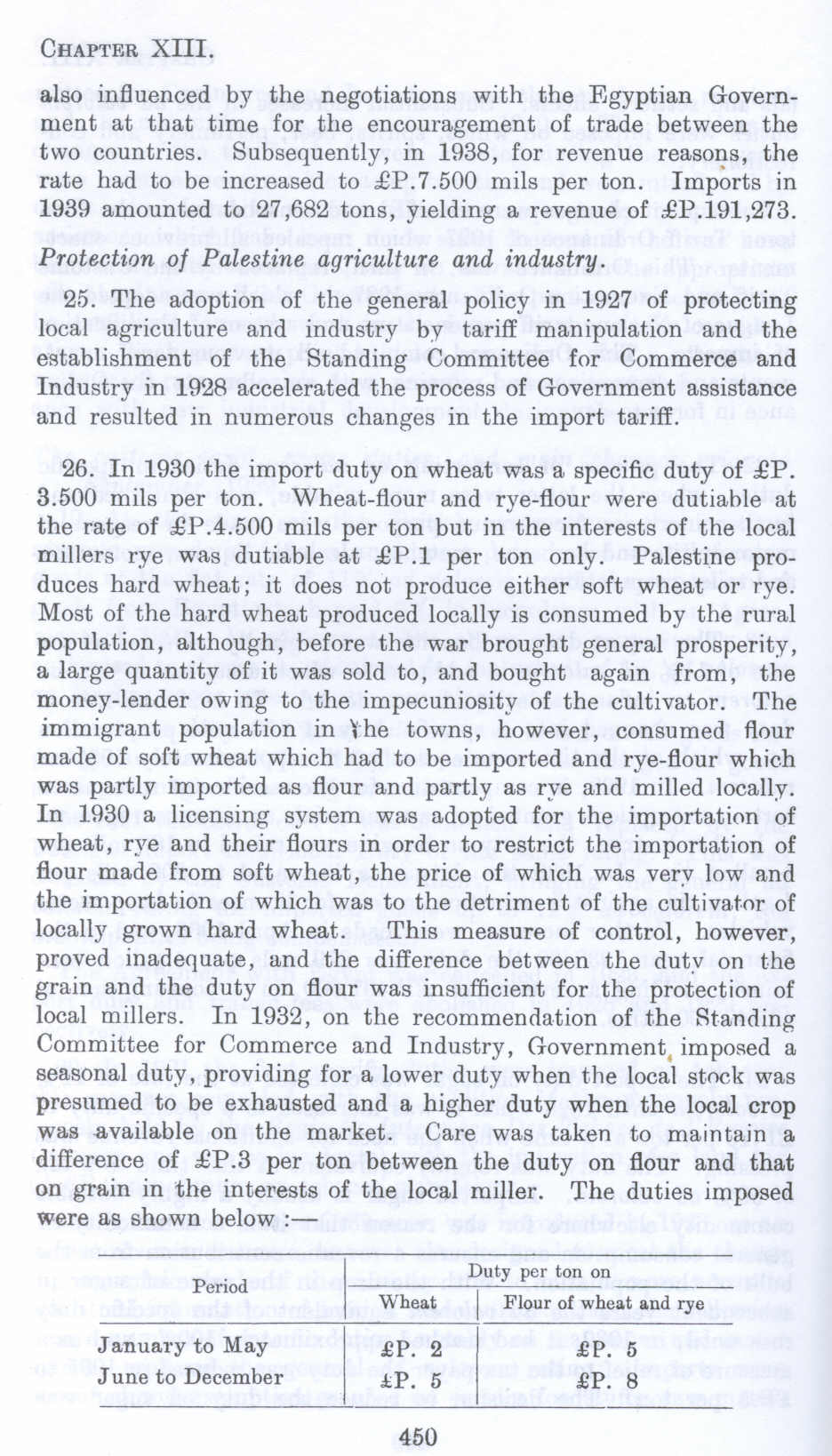

25. The adoption of the general policy in 1927 of protecting local agriculture and industry by tariff manipulation and the establishment of the Standing Committee for Commerce and Industry in 1928 accelerated the process of Government assistance and resulted in numerous changes in the import tariff.

26. In 1930 the import duty on wheat was a specific duty of £P. 3.500 mils per ton. Wheat-flour and rye-flour were dutiable at the rate of £P .4.500 mils per ton but in the interests of the local millers rye was dutiable at £P .1 per ton only. Palestine produces bard wheat; it does not produce either soft wheat or rye. Most of the hard wheat produced locally is consumed by the rural population, although, before the war brought general prosperity, a large quantity of it was sold to, and bought again from, the money-lender owing to the impecuniosity of the cultivator. The immigrant population in the towns, however, consumed flour made of soft wheat which had to be imported and rye-flour which was partly imported as flour and partly as rye and milled locally. In 1930 a licensing system was adopted for the importation of wheat, rye and their flours in order to restrict the importation of flour made from soft wheat, the price of which was very low and the importation of which was to the detriment of the cultivator of locally grown hard wheat. This measure of control, however, proved inadequate, and the difference between the duty on the grain and the duty on flour was insufficient for the protection of local millers. In 1932, on the recommendation of the Standing Committee for Commerce and Industry, Government, imposed a seasonal duty, providing for a lower duty when the local stock was presumed to be exhausted and a higher duty when the local crop was .available on the market. Care was taken to maintain a difference of £P .3 per ton between the duty on flour and that on grain in the interests of the local miller. The duties imposed were as shown below :-

Period

Wheat I Flour of wheat and rye

.January to May June to December

£P. 2 I £P. 5

£P. 5 £P. 8

Page 450