| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 459 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

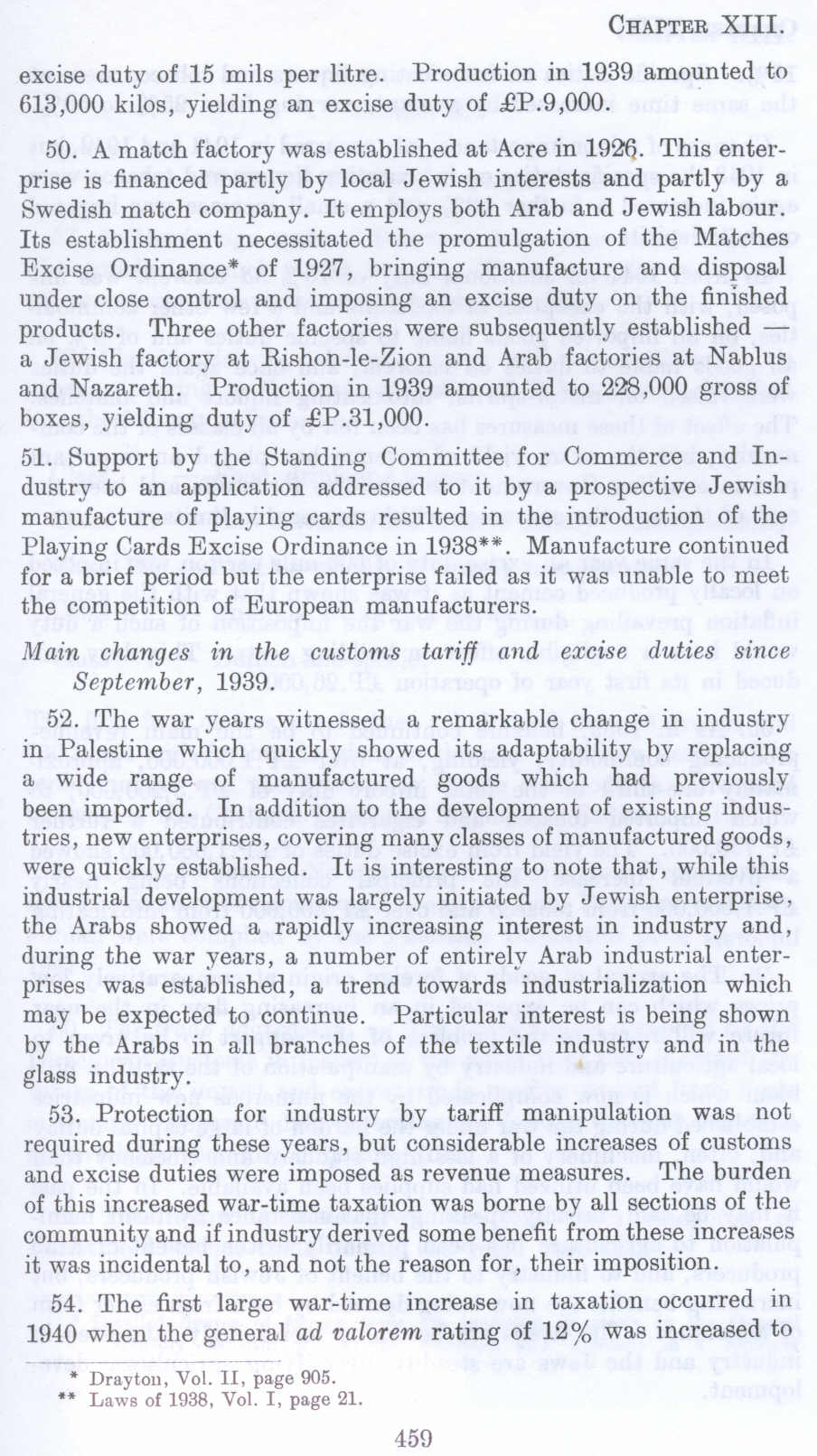

excise duty of 15 mils per litre. Production in 1939 amounted to 613,000 kilos, yielding an excise duty of £P.9,000.

50. A match factory was established at Acre in 192!\. This enterprise is financed partly by local Jewish interests and partly by a Swedish match company. It employs both Arab and Jewish labour. Its establishment necessitated the promulgation of the Matches Excise Ordinance* of 1927, bringing manufacture and disposal under close control and imposing an excise duty on the finished products. Three other factories were subsequently established - a Jewish factory at Rishon-le-Zion and Arab factories at Nablus and Nazareth. Production in 1939 amounted to 228,000 gross of boxes, yielding duty of £P.31,000.

51. Support by the Standing Committee for Commerce and Industry to an application addressed to it by a prospective Jewish manufacture of playing cards resulted in the introduction of the Playing Cards Excise Ordinance in 1938**. Manufacture continued for a brief period but the enterprise failed as it was unable to meet the competition of European manufacturers.

Main changes in the customs tariff and excise duties since September, 1939.

52. The war years witnessed a remarkable change in industry in Palestine which quickly showed its adaptability by replacing a wide range of manufactured goods which had previously been imported. In addition to the development of existing industries, new enterprises, covering many classes of manufactured goods, were quickly established. It is interesting to note that, while this industrial development was largely initiated by Jewish enterprise, the Arabs showed a rapidly increasing interest in industry and, during the war years, a number of entirely Arab industrial enterprises was established, a trend towards industrialization which may be expected to continue. Particular interest is being shown by the Arabs in all branches of the textile industry and in the glass industry.

53. Protection for industry by tariff manipulation was not required during these years, but considerable increases of customs and excise duties were imposed as revenue measures. The burden of this increased war-time taxation was borne by all sections of the community and if industry derived some benefit from these increases it was incidental to, and not the reason for, their imposition.

54. The first large war-time increase in taxation occurred in 1940 when the general ad valorem rating of 12% was increased to

__________________________________

* Drayton, Vol. 11, page 005 .

*** Laws of 1938. Vol. I, page 21.

Page 459