| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume I - Page 460 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

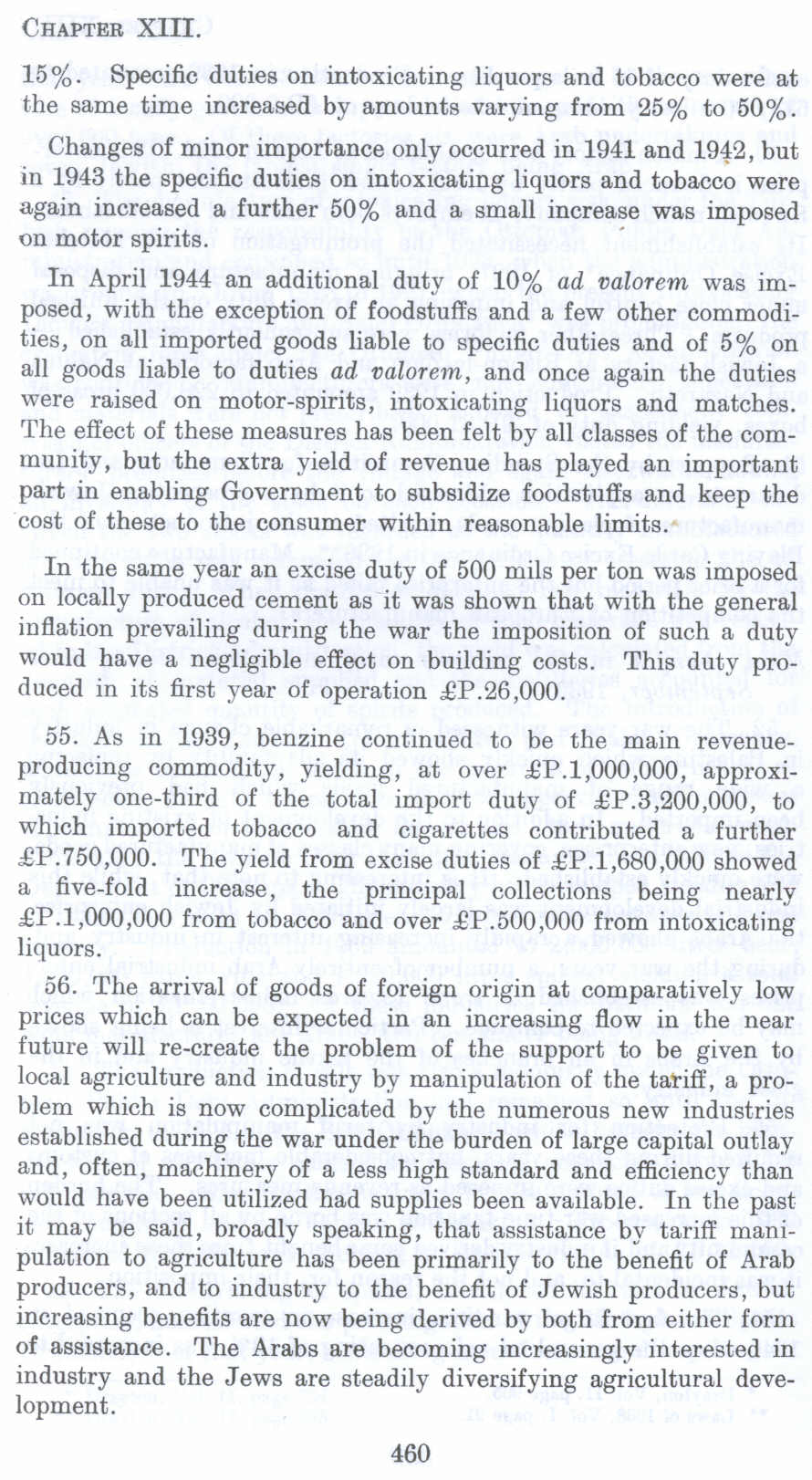

15 % . Specific duties on intoxicating liquors and tobacco were at the same time increased by amounts varying from 25% to 50%.

Changes of minor importance only occurred in 1941 and 1942, but in 1943 the specific duties on intoxicating liquors and tobacco were again increased a further 50% and a small increase was imposed on motor spirits. '

In April 1944 an additional duty of 10% ad valorem was imposed, with the exception of foodstuffs and a few other commodities, on all imported goods liable to specific duties and of 5% on all goods liable to duties ad valorem , and once again the duties were raised on motor-spirits, intoxicating liquors and matches. The effect of these measures has been felt by all classes of the community, but the extra yield of revenue has played an important part in enabling Government to subsidize foodstuffs and keep the cost of these to the consumer within reasonable limits.

In the same year an excise duty of 500 mils per ton was imposed on locally produced cement as it was shown that with the general inflation prevailing during the war the imposition of such a duty would have a negligible effect on building costs. This duty produced in its first year of operation £P.26,000.

55. As in 1939, benzene continued to be the main revenue producing commodity, yielding, at over £P.1,000,000 approximately one-third of the total import duty of £P.3,200,000, to which imported tobacco and cigarettes contributed a further £P.750,000. The yield from excise duties of £P.l,680,000 showed a five-fold increase, the principal collections being nearly £P.1,000,000 from tobacco and over £P.500,000 from intoxicating liquors.

56. The arrival of goods of foreign origin at comparatively low prices which can be expected in an increasing flow in the near future will re-create the problem of the support to be given to local agriculture and industry by manipulation of the tariff, a problem which is now complicated by the numerous new industries established during the war under the burden of large capital outlay and, often, machinery of a less high standard and efficiency than would have been utilized had supplies been available. In the past it may be said, broadly speaking, that assistance by tariff manipulation to agriculture has been primarily to the benefit of Arab producers, and to industry to the benefit of Jewish producers, but increasing benefits are now being derived by both from either form of assistance. The Arabs are becoming increasingly interested in industry and the Jews are steadily diversifying agricultural development.

Page 460