| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

Taxes in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume II - Page 543. Chapter XIV: Finance: Section 2: The System of Taxation |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

(a) Taxes.

13. As regards (a), taxes, the fiscal system of Palestine is still to some extent at a transition stage between the regime inherited from the Ottoman Government and a more scientific system of taxation. Considerable progress has been made in the transformation but the need for maintaining Government revenues at the highest possible level to meet peak phases of expenditure and to accumulate a balance against recurrent uncertainty as to the future has made further advance impracticable. The archaic element should not, however, be unduly emphasised. It only persists in the co-existence of such forms of taxation as are found in most modern administrations - customs and excise and income tax - and certain property taxes not directly related to income.

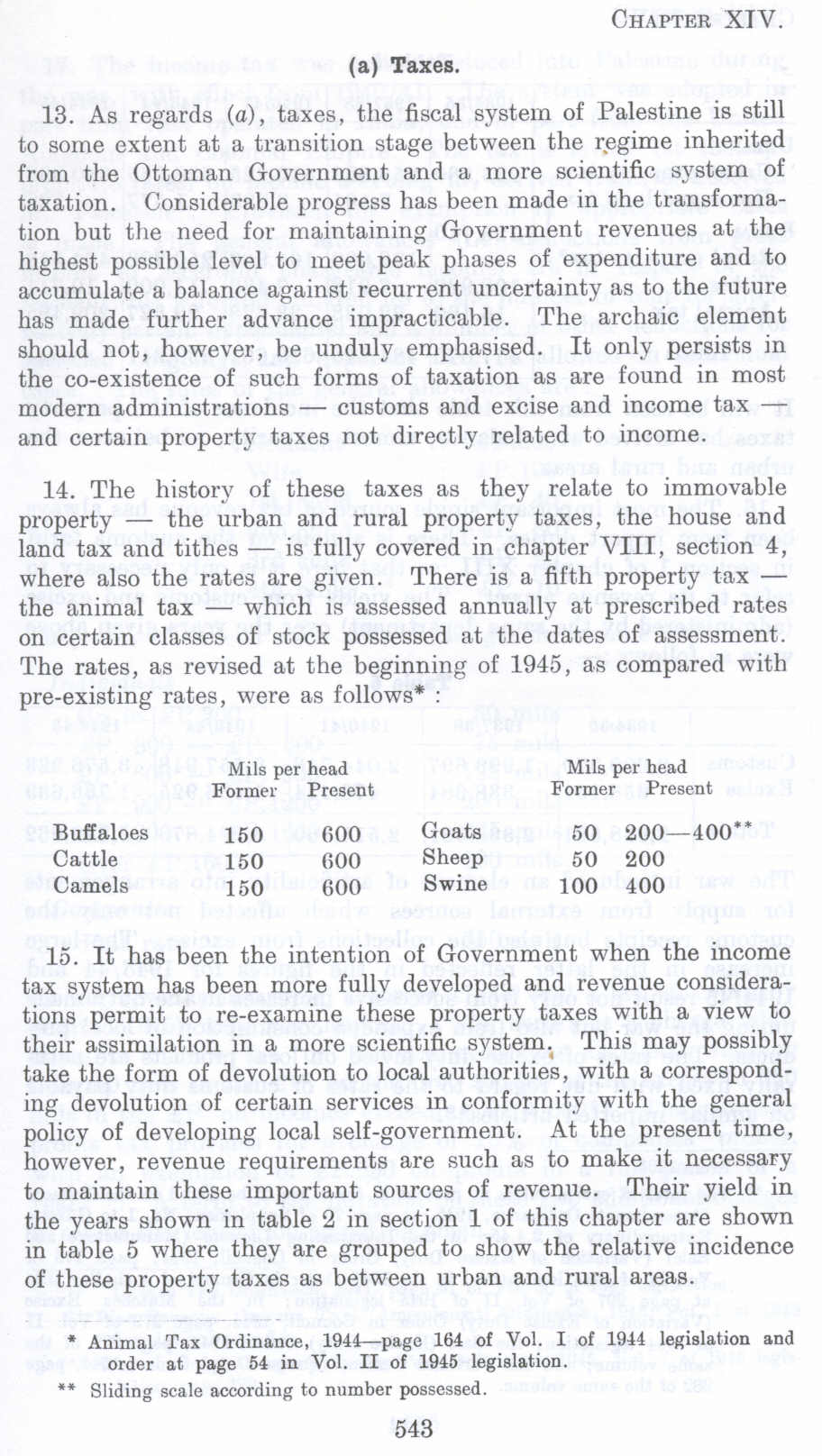

14. The history of these taxes as they relate to immovable property - the urban and rural property taxes, the house and land tax and tithes - is fully covered in chapter VIII, section 4, where also the rates are given. There is a fifth property tax - the animal tax - which is assessed annually at prescribed rates on certain classes of stock possessed at the dates of assessment. The rates, as revised at the beginning of 1945, as compared with pre-existing rates, were as follows*:

Mils per head Mils per head

Former Present Former Present

Buffaloes 150 GOO Goats 50 200-400**

Cattle 150 GOO Sheep 50 200

Camels 150 600 Swine 100 400

15. It has been the intention of Government when the income tax system has been more fully developed and revenue considerations permit to re-examine these property taxes with a view to their assimilation in a more scientific system, This may possibly take the form of devolution to local authorities, with a corresponding devolution of certain services in conformity with the general policy of developing local self-government. At the present time, however, revenue requirements are such as to make it necessary to maintain these important sources of revenue. Their yield in the years shown in table 2 in section 1 of this chapter are shown in table 5 where they are grouped to show the relative incidence of these property taxes as between urban and rural areas.

_________

* Animal Tax Ordinance, 1944-pago 164 of Vol. I of 19!4 legislation and order at page 54 in Vol. II of 1945 legislation.

** Sliding scale according to number possessed.

543