| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

Urban and Rural Property Taxes, Table 6: Yield From Custom and Excise 1934-1945 in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume II - Page 544. Chapter XIV: Finance: Section 2: The System of Taxation : Table 5 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

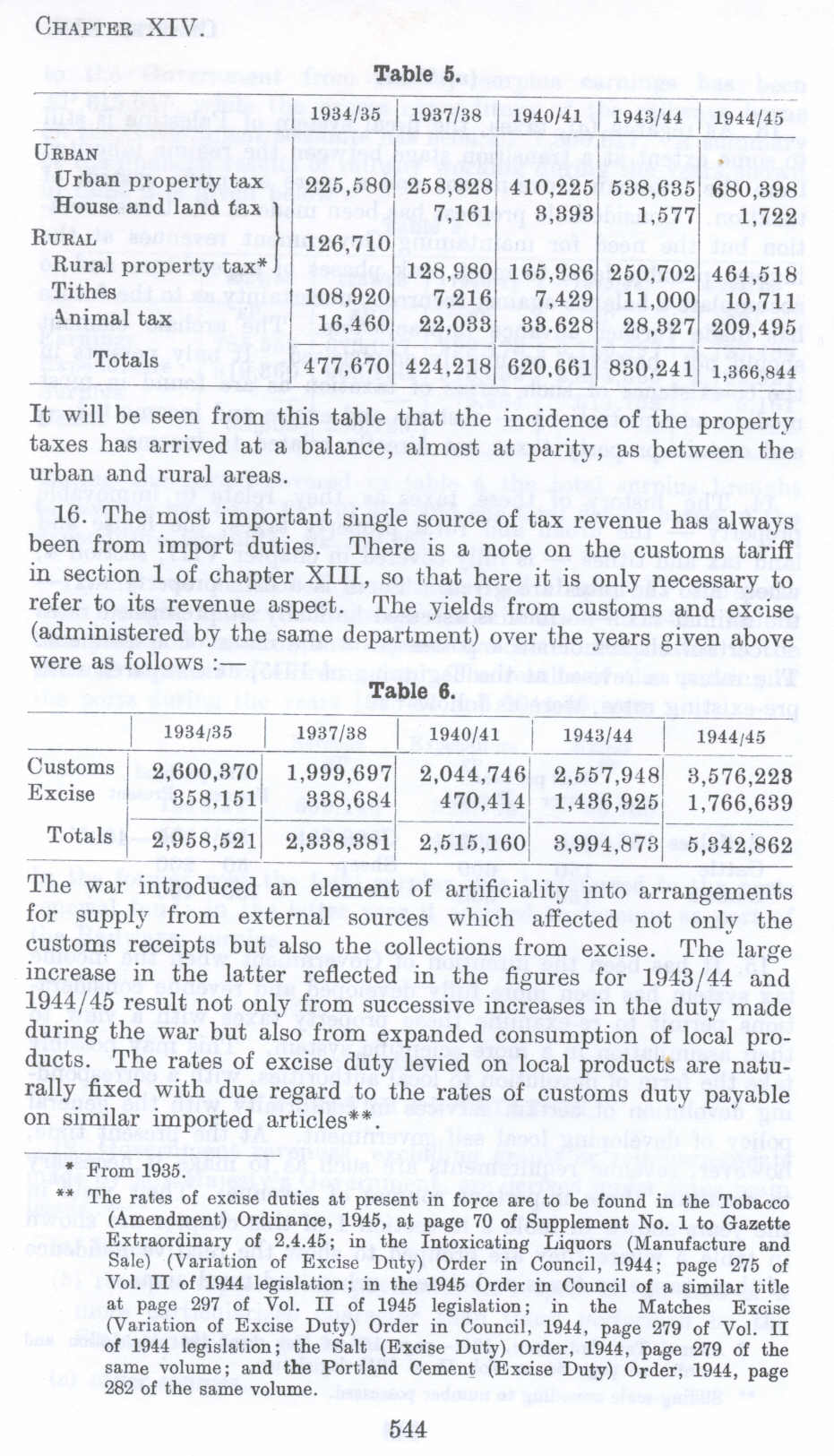

Table 5.

1934/35 11937/38 j 1940/41 j 1943/44 11944/45

225,580, 258,8281410,22511 538,6351680,398

7,1611 8,393 l,577 1,722

URBAN

Urban property tax House and land tax )

RURAL

Rural property tax* Tithes

Animal tax

126,710

128,9801165,986 250,7021464,518

108,920 7,216 7,429 11,000 10,711

16,4601 22,033 38.628 28,327 209.495

Totals 424:2iBIG20:66183ci.2ill ~~

It will be seen from this table that the incidence of the property taxes has arrived at a balance, almost at parity, as between the urban and rural areas.

16. The most important single source of tax revenue has always been from import duties. There is a note on the customs tariff in section 1 of chapter XIII, so that here it is only necessary to refer to its revenue aspect. The yields from customs and excise (administered by the same department) over the years given above were as follows :-

Table 6.

I 1934/35 1937/38 I 1940/41 I 1943/44

Customs I 2,600,8701 1,999,69712,044,74GI 2,557,9481 Excise 358,151 338,684 470,414 1,436,925

Totals /_ 2,958,5211 2,338,881 2,515,1601 3,994,8731

1944/45 3,576,228 1,766,639

5,342;862

The war introduced an element of artificiality into arrangements for supply from external sources which affected not only the customs receipts but also the collections from excise. The large increase in the latter reflected in the figures for 1943 / 44 and 1944/45 result not only from successive increases in the duty made during the war but also from expanded consumption of local products. The rates of excise duty levied on local products are naturally fixed with due regard to the rates of customs duty payable on similar imported articles=".

_______

* From 1935.

** The rates of excise duties at present in force are to be found in the Tobacco (Amendment) Ordinance, 1945, at page 70 of Supplement No. 1 to Gazette Extraordinary of 2.4.45; in the Intoxicating Liquors (Manufacture and Sale) (Variation of Excise Duty) Order in Council, 1944; page 275 of Vol. II of 1944 legislation , in the 1945 Order in Council of a. similar title at page 297 of Vol. II of 1945 legislation; in the Matches Excise (Variation of Excise Duty) Order in Council, 1944, page 279 of Vol. II of 1944 legislation; the SaIt (Excise Duty) Order, 1944, page 279 of the same volume; and the Portland Cement (Excise Duty) Order, 1944, page 282 of the same volume.

544