| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume II - Page 545 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

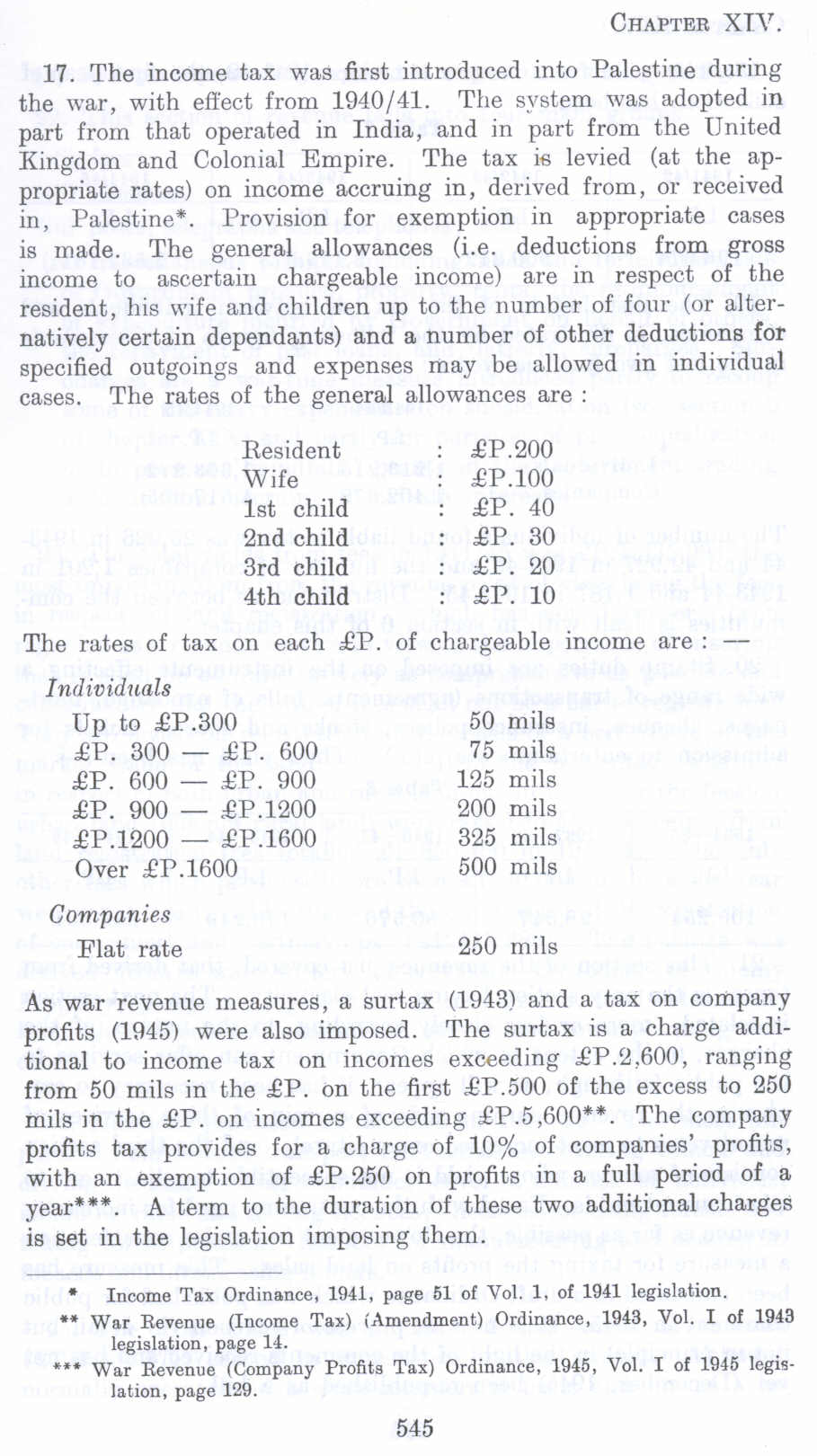

17. The income tax was first introduced into Palestine during the war, with effect from 1940/41. The system was adopted in part from that operated in India, and in part from the United Kingdom and Colonial Empire. The tax is levied (at the appropriate rates) on income accruing in 1 derived from, or received in, Palestine*. Provision for exemption in appropriate cases is made. The general allowances (i.e. deductions from gross income to ascertain chargeable income) are in respect of the resident, his wife and children up to the number of four (or alternatively certain dependents) and a number of other deductions for specified outgoings and expenses may be allowed in individual cases. The rates of the general allowances are :

Resident Wife

1st child 2nd child 3rd child 4th child

£P.200 £P.100 £P. 40 £P. 30 £P. 20 £P. 10

The rates of tax on each £P. of chargeable income are : - Individuals

Up to £P.300

£P. 300 - £P. 600 £P. 600 - £P. 900 £P. 900 - .£P .1200 £P.1200 - £P.1600 Over £P.1600

Companies Flat rate

50 mils 75 mils 125 mils 200 mils 325 mils 500 mils

250 mils

As war revenue measures, a surtax (1943) and a tax on company profits (1945) were also imposed. The surtax is a charge additional to income tax on incomes exceeding £P.2~600, ranging from 50 mils in the £P. on the first £P.500 of the excess to 250 mils in the £P. on incomes exceeding £P.5,600**. The company profits tax provides for a charge of 10% of companies' profits, with an exemption of £P.250 on profits in a full period of a year***. A term to the duration of these two additional charges is set in the legislation imposing them.

Income Tax Ordinance, 1941, page 51 of Vol. l, of 1941 legislation.

** War Revenue (Income Tax) (Amendment) Ordinance, 1943, Vol. I of 1943 legislation, page 14.

*** War Revenue (Company Profits Tax) Ordinance, 1945, Vol. I of 1945 legislation, page 129.

545