| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

Tables showing Yield From Income Tax For Years 1941-1945, and Duties Collected on Wide Range of Transaction in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume II - Page 546. Chapter XIV: Finance: Section 2: The System of Taxation : Table 7 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

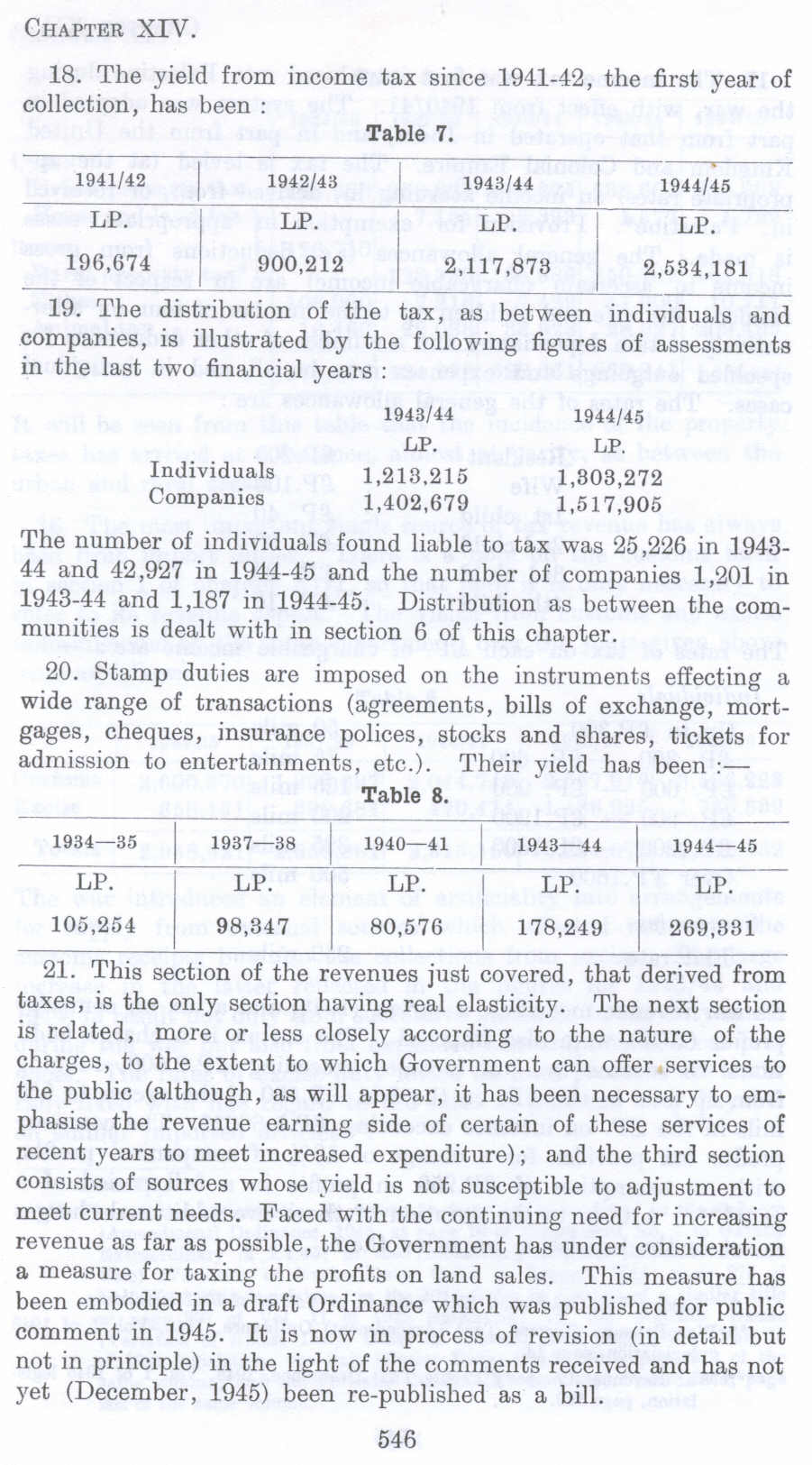

18. The yield from income tax since 1941-42, the first year of collection, has been :

Table 7.

1941/42

1942/43

1943/44

1944/45

LP. 196,674

LP. 900,212

LP. 2,117,873

LP.

2,534,181

19. The distribution of the tax, as between individuals and companies, is illustrated by the following figures of assessments in the last two financial years :

1943/44 1944/45

LP. LP.

Individuals 1,213.215 1,303,272

Companies 1,402,679 1,517,905 The number of individuals found liable to tax was 25,226 in 1943- 44 and 42,927 in 1944-45 and the number of companies 1,201 in 1943-44 and 1,187 in 1944-45. Distribution as between the communities is dealt with in section 6 of this chapter.

20. Stamp duties are imposed on the instruments effecting a wide range of transactions (agreements, bills of exchange, mortgages, cheques, insurance polices, stocks and shares, tickets for admission to entertainments, etc.). Their yield has been :-

Table 8.

1934-35

1937-38

1940-41

1943-44

1944-45

LP. 105,254

LP. 98,347

LP. 80,576

LP. 178,249

LP. 269,331

21. This section of the revenues just covered, that derived from taxes, is the only section having real elasticity. The next section is related, more or less closely according to the nature of the charges, to the extent to which Government can offer services to the public (although, as will appear, it has been necessary to emphasise the revenue earning side of certain of these services of recent years to meet increased expenditure); and the third section consists of sources whose yield is not susceptible to adjustment to meet current needs. Faced with the continuing need for increasing revenue as far as possible, the Government has under consideration a measure for taxing the profits on land sales. This measure has been embodied in a draft Ordinance which was published for public comment in 1945. It is now in process of revision (in detail but not in principle) in the light of the comments received and has not yet (December, 1945) been re-published as a bill.

546