| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

Receipts representing payment in respect of services performed by the Palestinian Government before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume II - Page 547. Chapter XIV: Finance: Section 2: The System of Taxation : (b) |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

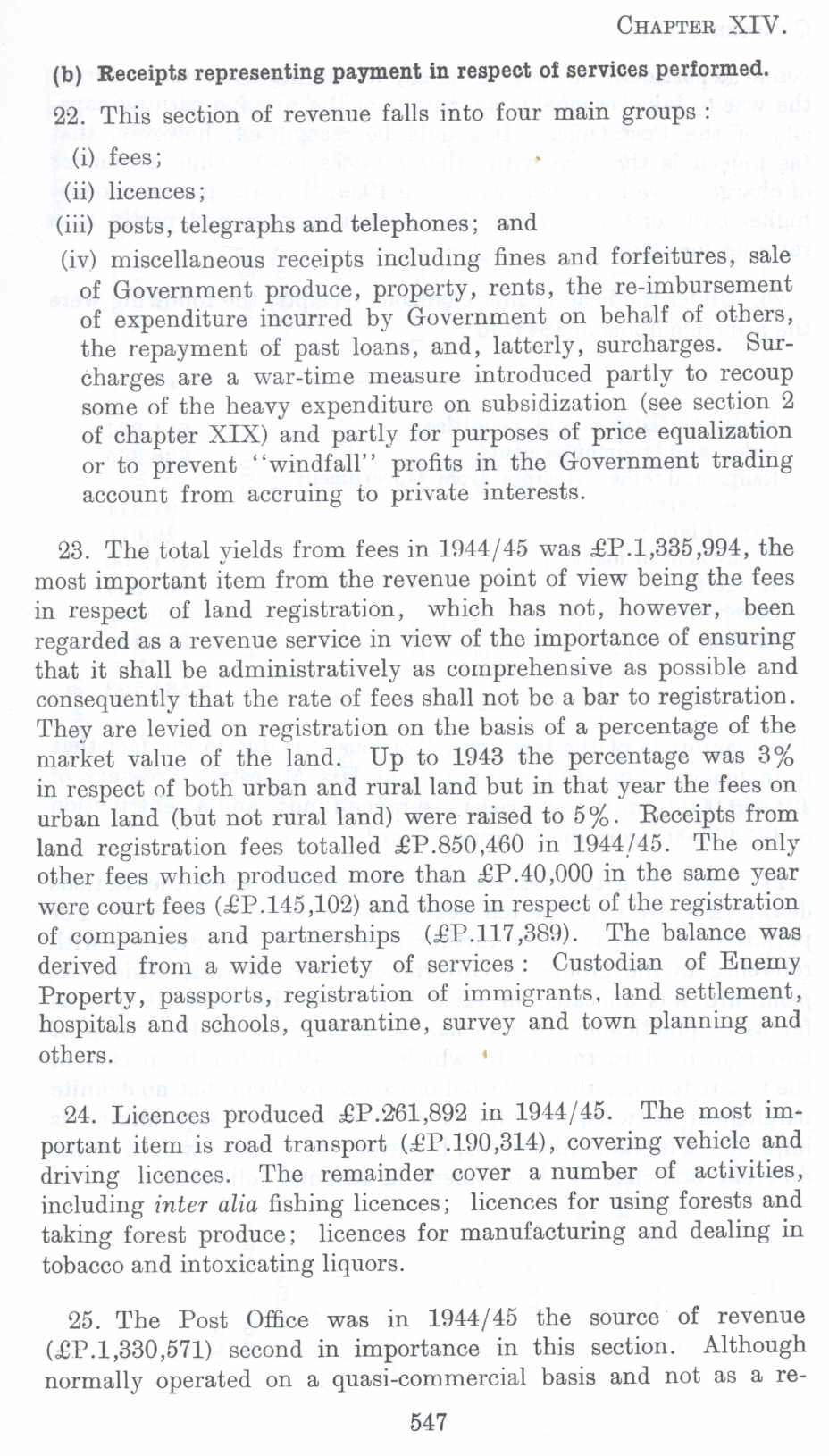

(b) Receipts representing payment in respect ol services performed. 22. This section of revenue falls into four main groups :

(i) fees;

(ii) licences;

(iii) posts, telegraphs and telephones; and

(iv) miscellaneous receipts including fines and forfeitures, sale of Government produce, property, rents, the re-imbursement of expenditure incurred by Government on behalf of others, the repayment of past loans, and, latterly, surcharges. Surcharges are a war-time measure introduced partly to recoup some of the heavy expenditure on subsidization (see section 2 of chapter XIX) and partly for purposes of price equalization or to prevent "windfall" profits in the Government trading account from accruing to private interests.

23. The total yields from fees in l\l44/45 was £P.l,335,994, the most important item from the revenue point of view being the fees in respect of land registration, which has not, however, been regarded as a revenue service in view of the importance of ensuring that it shall be administratively as comprehensive as possible and consequently that the rate of fees shall not be a bar to registration. They are levied on registration on the basis of a percentage of the market value of the land. Up to 1943 the percentage was 3% in respect of both urban and rural land but in that year the fees on urban land (but not rural land) were raised to 5%. Receipts from land registration fees totaled £P.850,460 in 1944/45. The only other fees which produced more than £P.40,000 in the same year were court fees (£P.145 ,102) and those in respect of the registration of companies and partnerships (£P.117,38U). The balance was derived from a wide variety of services : Custodian of Enemy Property, passports, registration of immigrants, land settlement, hospitals and schools, quarantine, survey and town planning and others.

24. Licences produced £P.261,892 in 1944/45. The most important item is road transport (£P.190,314), covering vehicle and driving licences. The remainder cover a number of activities, including inter alia fishing licences; licences for using forests and taking forest produce; licences for manufacturing and dealing in tobacco and intoxicating liquors.

25. The Post Office was in 1944/45 the source of revenue (£P.1,330,571) second in importance in this section. Although normally operated on a quasi-commercial basis and not as a re-

547