| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume II - Page 571 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

time financing and a somewhat imperfect observance of the canons of taxation other than the canon of ease and certainty of collection.

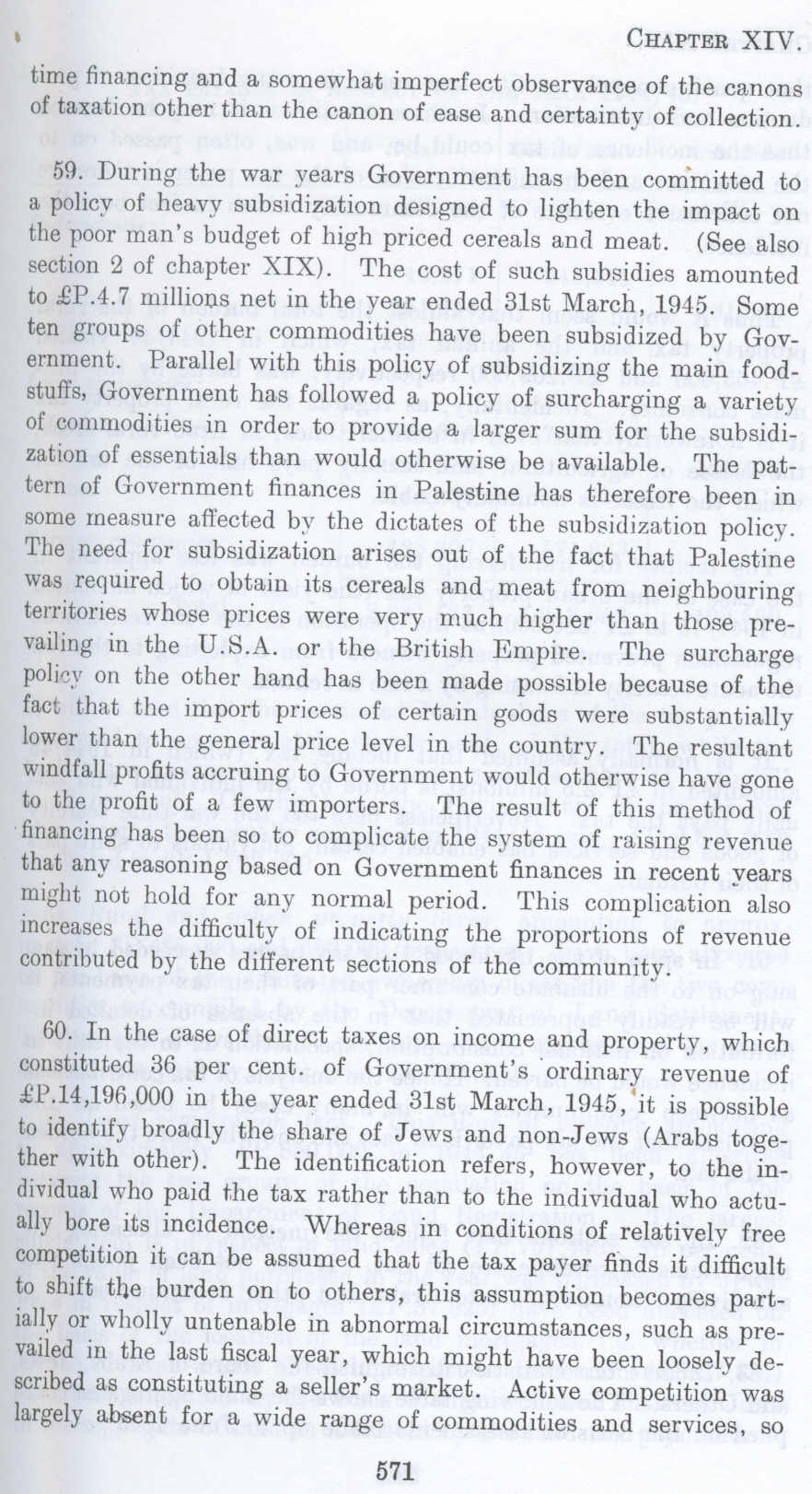

59. During the war years Government has been committed to a policy of heavy subsidization designed to lighten the impact on the poor man's budget of high priced cereals and meat. (See also section 2 of chapter XIX). The cost of such subsidies amounted to £P.4.7 millions net in the year ended 31st March, 1945. Some ten groups of other commodities have been subsidized by Government. Parallel with this policy of subsidizing the main foodstuffs, Government has followed a policy of surcharging a variety of commodities in order to provide a larger sum for the subsidization of essentials than would otherwise be available. The pattern of Government finances in Palestine has therefore been in some measure affected bv the dictates of the subsidization policy. The need for subsidization arises out of the fact that Palestine was required to obtain its cereals and meat from neighbouring territories whose prices were very much higher than those prevailing in the U.S.A. or the British Empire. The surcharge poliey on the other hand has been made possible because of the fact that the import prices of certain goods were substantially lower than the general price level in the country. The resultant windfall profits accruing to Government would otherwise have gone to the profit of a few importers. The result of this method of financing has been so to complicate the system of raising revenue that any reasoning based on Government finances in recent years might not bold for any normal period. This complication also increases the difficulty of indicating the proportions of revenue contributed by the different sections of the community.

60. In the case of direct taxes on income and property, which constituted 36 per cent. of Government's ordinary revenue of £P.14,195,000 in the year ended 31st March, 1945, 'it is possible to identify broadly the share of Jews and non-Jews (Arabs together with other). The identification refers, however, to the individual who paid the tax rather than to the individual who actually bore its incidence. Whereas in conditions of relatively free competition it can be assumed that the tax payer finds it difficult to shift the burden on to others, this assumption becomes partially or wholly untenable in abnormal circumstances, such as prevailed in the last fiscal year, which might have been loosely described as constituting a seller's market. Active competition was largely absent for a wide range of commodities and services, so

571