| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

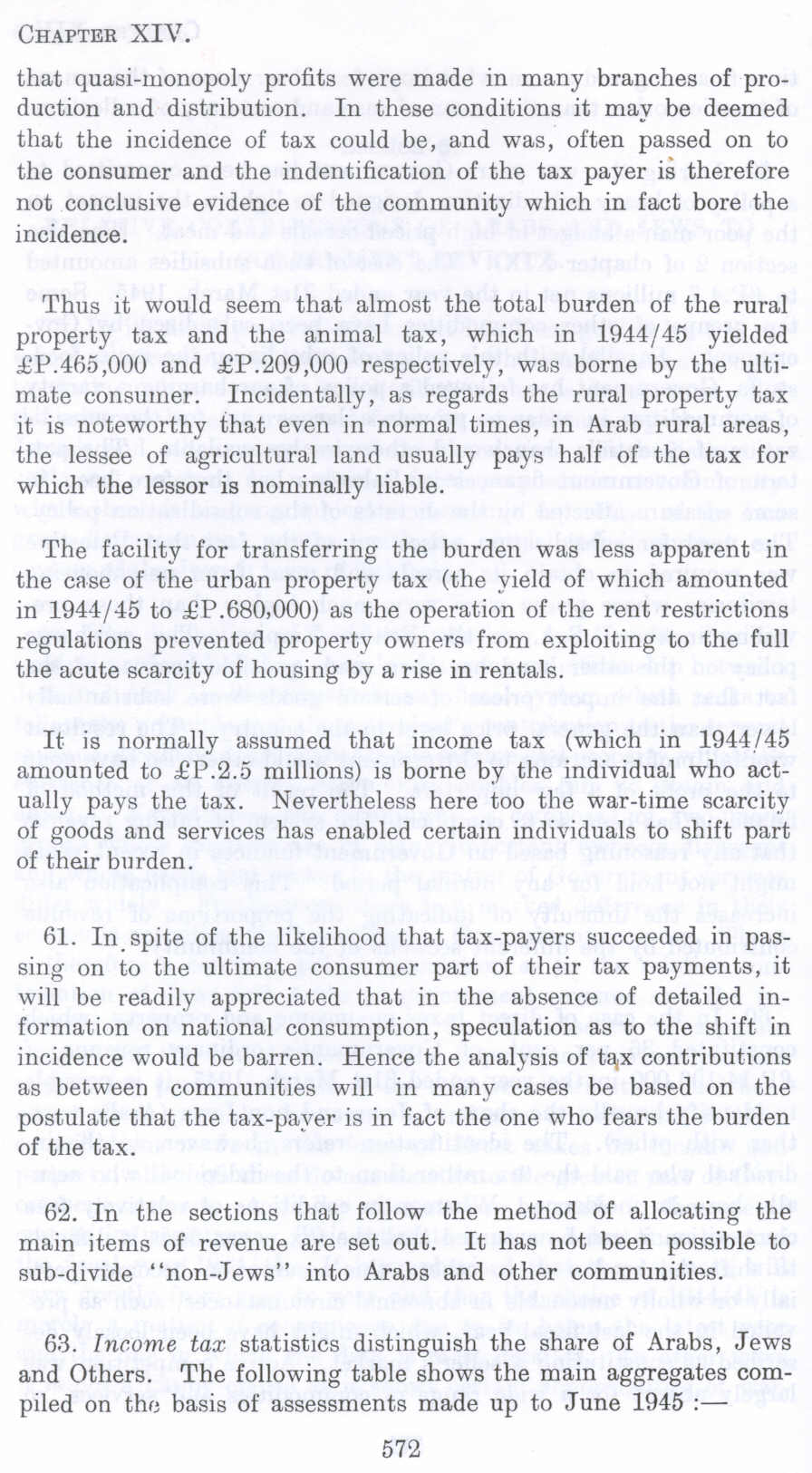

British Mandate: A Survey of Palestine: Volume II - Page 572 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

that quasi-monopoly profits were made in many branches of production and distribution. In these conditions it may be deemed that the incidence of tax could be, and was, often passed on to the consumer and the indentification of the tax payer is therefore not conclusive evidence of the community which in fact bore the incidence.

Thus it would seem that almost the total burden of the rural property tax and the animal tax, which in 1944/45 yielded £P.465,000 and £P.209,000 respectively, was borne by the ultimate consumer. Incidentally, as regards the rural property tax it is noteworthy that even in normal times, in Arab rural areas, the lessee of agricultural land usually pays half of the tax for which the lessor is nominally liable.

The facility for transferring the burden was less apparent in the case of the urban property tax (the yield of which amounted in 1944/45 to £P.680,000) as the operation of the rent restrictions regulations prevented property owners from exploiting to the full the acute scarcity of housing by a rise in rentals.

It is normally assumed that income tax (which in 1944/45 amounted to £P.2.5 millions) is borne by the individual who actually pays the tax. Nevertheless here too the war-time scarcity of goods and services has enabled certain individuals to shift part of their burden.

61. In. spite of the likelihood that tax-payers succeeded in passing on to the ultimate consumer part of their tax payments, it will be readily appreciated that in the absence of detailed information on national consumption, speculation as to the shift in incidence would be barren. Hence the analysis of tax contributions as between communities will in many cases be based on the postulate that the tax-payer is in fact the one who fears the burden of the tax.

62. In the sections that follow the method of allocating the main items of revenue are set out. It has not been possible to sub-divide "non-Jews" into Arabs and other communities.

63. Income tax statistics distinguish the share of Arabs, Jews and Others. The following table shows the main aggregates compiled on tho basis of assessments made up to June 1945 :-

572