| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

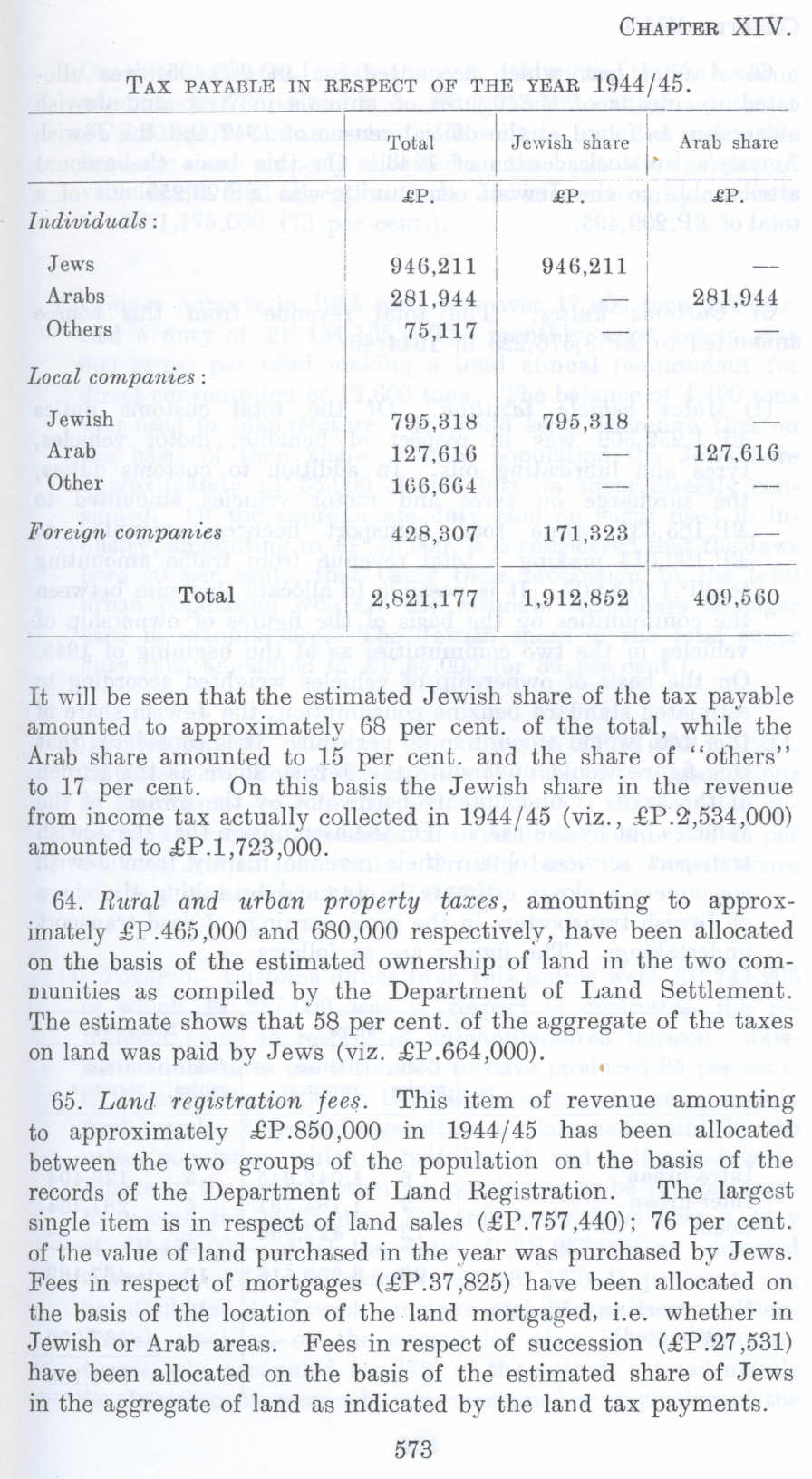

Tax Payable in Respect of The Year 1944/45 in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume II - Page 573. Chapter XIV: Finance: Section 6: Relative Contribution of Arabs and Jewish Government Revenue |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

TAX PAYABLE IN RESPECT OF TEE YEAR 1944/45.

Total Jewish share _ _i. Arab share

£P. I £P. £P.

individuals :

Jews 94G,211 946,211

Arabs 281,944 ; 281,944

Others 75,117

Local companies :

Jewish 795,318 795,318

Arab 127,61G I 127,616

Other 166,664

Foreign companies 428,307 171,323

Total 2,821,177 1,912,852 409,560

It will be seen that the estimated Jewish share of the tax payable amounted to approximately 68 per cent. of the total, while the Arab share amounted to 15 per cent. and the share of "others" to 17 per cent. On this basis the Jewish share in the revenue from income tax actually collected in 1944/45 (viz., £P.2,534,000) amounted to £P.l,723,000.

64. Rural and Urban property taxes, amounting to approximately £P.465 ,000 and 680,000 respectively, have been allocated on the basis of the estimated ownership of land in the two communities as compiled by the Department of Laud Settlement. The estimate shows that 58 per cent. of the aggregate of the taxes on land was paid by Jews (viz. £P.664,000).

65. Land registration fees. This item of revenue amounting to approximately £P.850,000 in 1944/45 has been allocated between the two groups of the population on the basis of the records of the Department of Land Registration. The largest single item is in respect of land sales (£P. 757,440); 76 per cent. of the value of land purchased in the year was purchased by Jews. Fees in respect of mortgages (£P.37 ,825) have been allocated on the basis of the location of the land mortgaged, i.e. whether in Jewish or Arab areas. Fees in respect of succession (£P. 27,531) have been allocated on the basis of the estimated share of Jews in the aggregate of land as indicated by the land tax payments.

573