| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume II - Page 574 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

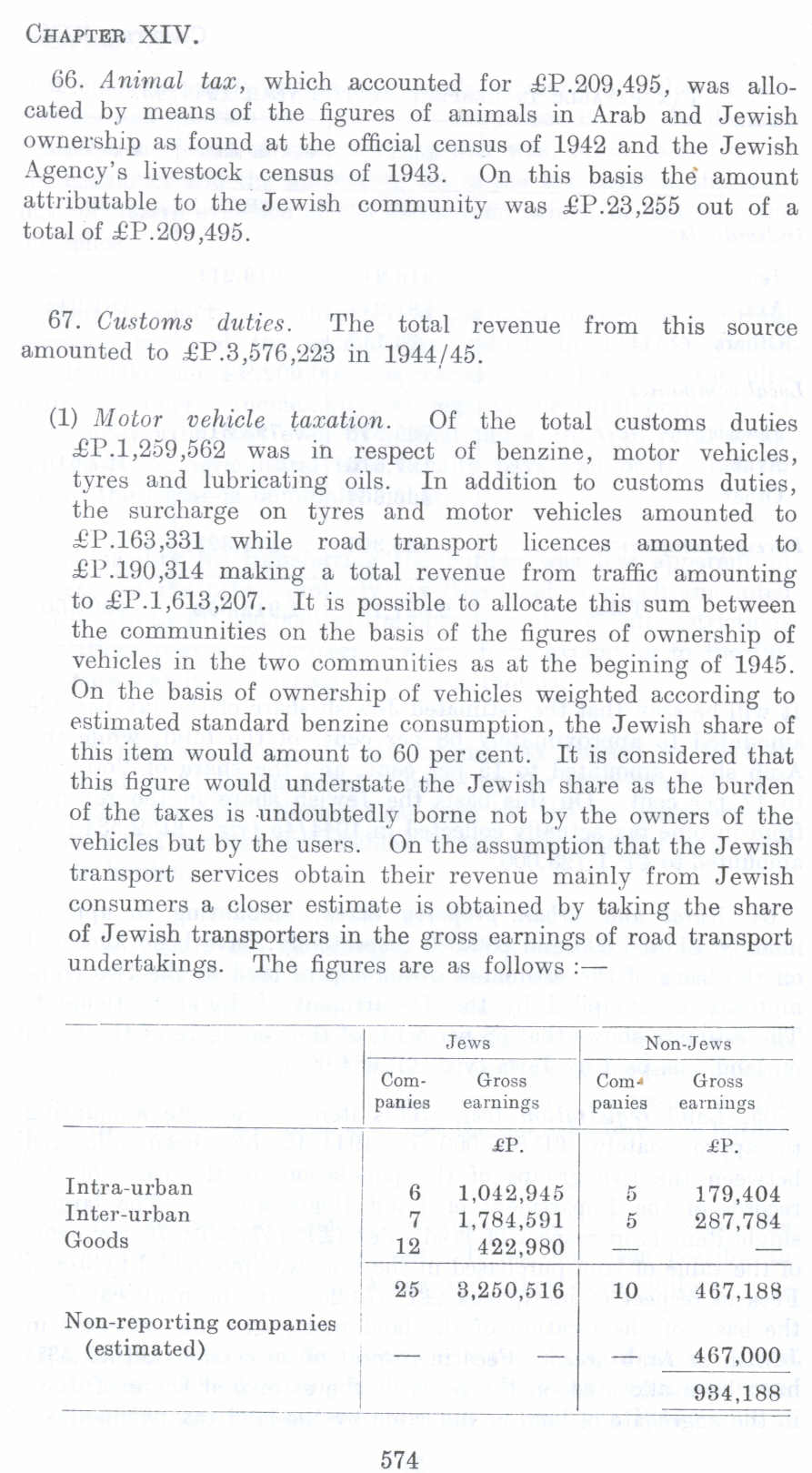

66. Animal tax, which accounted for £P.209,495, was allocated by means of the figures of animals in Arab and Jewish ownership as found at the official census of 1942 and the Jewish Agency's livestock census of 1943. On this basis the amount attributable to the Jewish community was £P.23,255 out of a total of £P. 209 ,495.

67. Customs duties, The total revenue from this source amounted to £P.3,576,223 in 1944/45.

(1) AI otor vehicle taxation. Of the total customs duties £P.l,259,562 was in respect of benzine, motor vehicles, tyres and lubricating oils. In addition to customs duties, the surcharge on tyres and motor vehicles amounted to £P.163,331 while road transport licences amounted to £P.190,314 making a total revenue from traffic amounting to £P.l,613,207. It is possible to allocate this sum between the communities on the basis of the figures of ownership of vehicles in the two communities as at the beginning of 1945. On the basis of ownership of vehicles weighted according to estimated standard benzine consumption, the Jewish share of this item would amount to 60 per cent. It is considered that this figure would understate the Jewish share as the burden of the taxes is undoubtedly borne not by the owners of the vehicles but by the users. On the assumption that the Jewish transport services obtain their revenue mainly from Jewish consumers a closer estimate is obtained by taking the share of Jewish transporters in the gross earnings of road transport undertakings. The figures are as follows :-

I- Jews I Non-Jews

-------

Com• Gross Companies earnings Gross

earnings

l £P. £P.

Intra-urban G 1,042,945 5 179,404

Inter-urban I 7 1.784,591 5 287,784

Goods 12 422,980

25 3,260.516 IO 467,188

Non-reporting companies

(estimated) - 467,000

I 934,188

----- --- -------

574