| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume II - Page 575 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

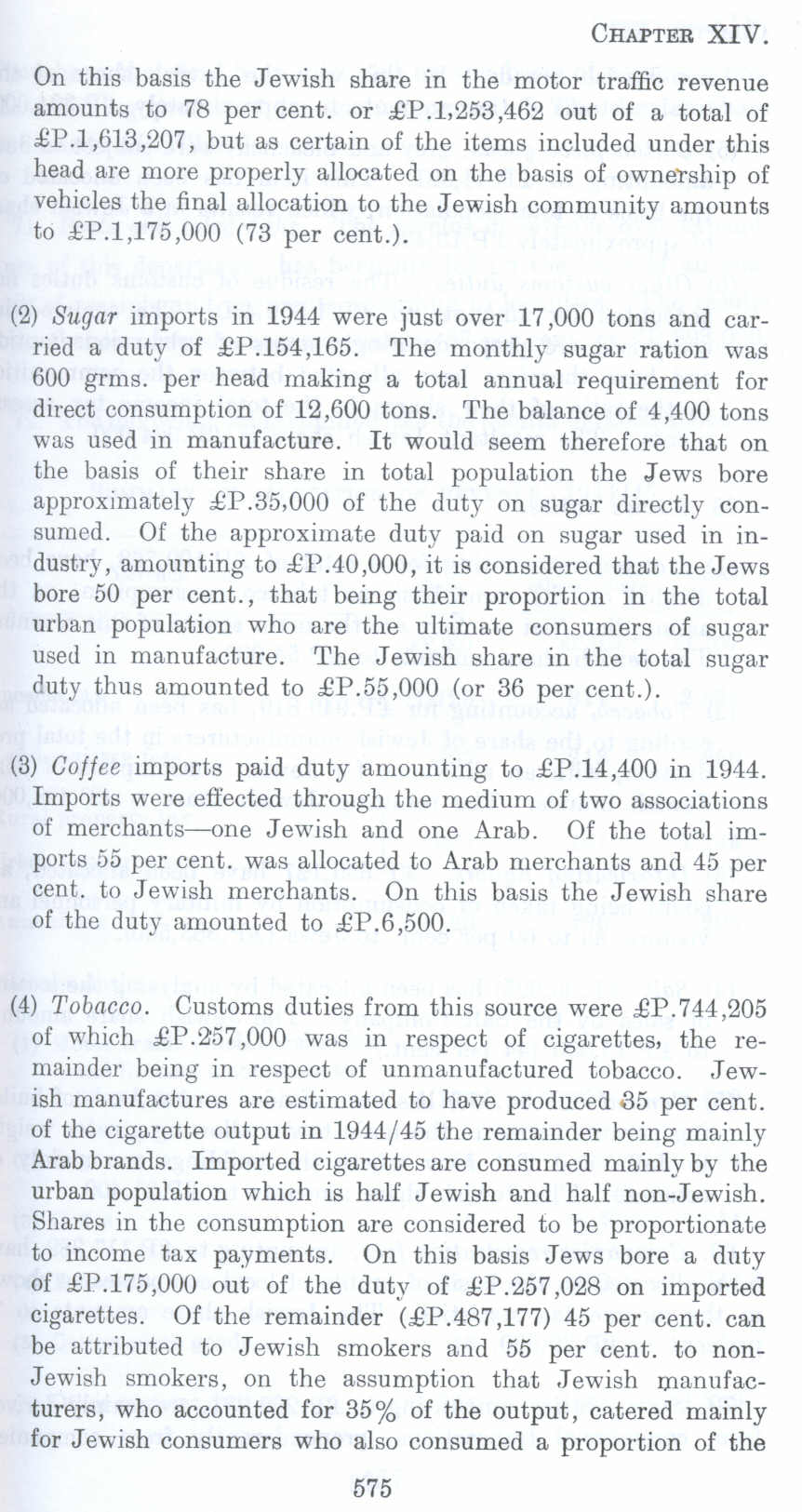

On this basis the Jewish share in the motor traffic revenue amounts to 78 per cent. or £P.1.253,462 out of a total of £P.l,613,207, but as certain of the items included under this head are more properly allocated on the basis of ownership of vehicles the final allocation to the Jewish community amounts to £P.l,175,000 (73 per cent.).

(2) Sugar imports in 1944 were just over 17,000 tons and carried a duty of £P.154,165. The monthly sugar ration was 600 grms. per head making a total annual requirement for direct consumption of 12,600 tons. The balance of 4,400 tons was used in manufacture. It would seem therefore that on the basis of their share in total population the Jews bore approximately £P.35,000 of the duty on sugar directly consumed. Of the approximate duty paid on sugar used in industry, amounting to £P.40,000, it is considered that the Jews bore 50 per cent., that being their proportion in the total urban population who are the ultimate consumers of sugar used in manufacture. The Jewish share in the total sugar duty thus amounted to £P.55,000 (or 36 per cent.).

(3) Coffee imports paid duty amounting to £P.14,400 in 1944.

Imports were effected through the medium of two associations of merchants-one Jewish and one Arab. Of the total imports 55 per cent. was allocated to Arab merchants and 45 per cent. to Jewish merchants. On this basis the Jewish share of the duty amounted to £P.6,500.

(4) Tobacco. Customs duties from this source were £P.744,205 of which £P.257 ,000 was in respect of cigarettes, the remainder being in respect of unmanufactured tobacco. Jewish manufactures are estimated to have produced 85 per cent. of the cigarette output in 1944/45 the remainder being mainly Arab brands. Imported cigarettes are consumed mainly by the urban population which is half Jewish and half non-Jewish. Shares in the consumption are considered to be proportionate to income tax payments. On this basis Jews bore a duty of £P.175,000 out of the duty of £P.257 ,028 on imported cigarettes. Of the remainder (£P.487 ,177) 45 per cent. can be attributed to Jewish smokers and 55 per cent. to non Jewish smokers, on the assumption that Jewish manufacturers, who accounted for 35% of the output, catered mainly for Jewish consumers who also consumed a proportion of the

575