| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume II - Page 576 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

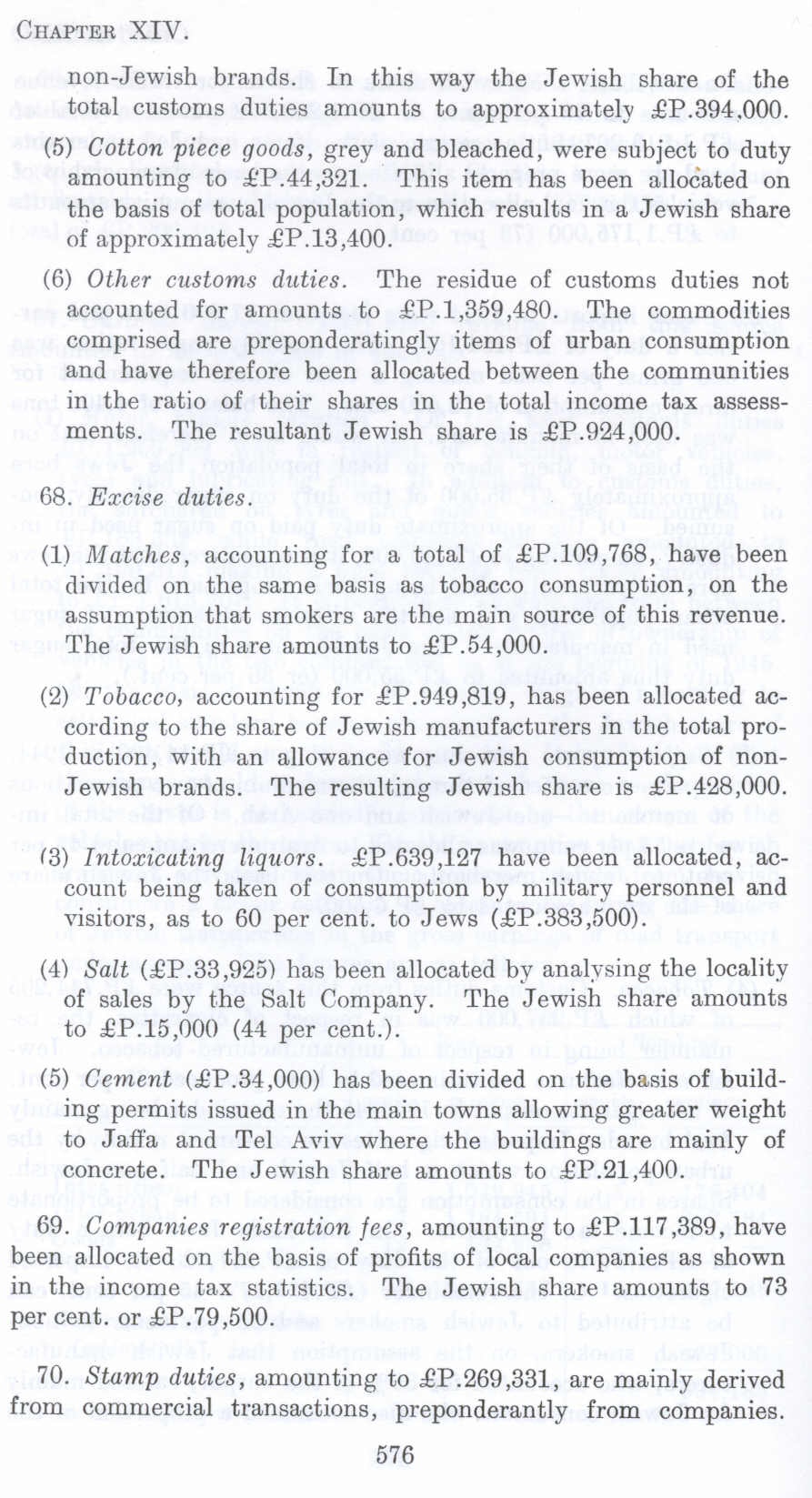

non-Jewish brands. In this way the Jewish share of the total customs duties amounts to approximately £P.394.000.

(5) Cotton piece goods, grey and bleached, were subject to duty amounting to £P.44,321. This item has been allocated on the basis of total population, which results in a Jewish share of approximately £P.13,400.

(6) Other customs duties. The residue of customs duties not accounted for amounts to £P.l,359,480. The commodities comprised are preponderating items of urban consumption and have therefore been allocated between the communities in the ratio of their shares in the total income tax assessments. The resultant Jewish share is £P.924,000.

68. Excise duties.

(1) Matches, accounting for a total of £P.109,768, have been divided on the same basis as tobacco consumption, on the assumption that smokers are the main source of this revenue. The Jewish share amounts to £P.54,000.

(2) Tobacco, accounting for £P.949,819, has been allocated according to the share of Jewish manufacturers in the total production, with an allowance for Jewish consumption of non-Jewish brands. The resulting Jewish share is £P.428,000.

(3) Intoxicating liquors. £P.639,127 have been allocated, account being taken of consumption by military personnel and visitors, as to 60 per cent. to Jews (£P.383,500).

(4) Salt (£P.33,925) has been allocated by analysing the locality of sales by the Salt Company. The Jewish share amounts to £P.15,000 (44 per cent.).

(5) Cement (£P.34,000) has been divided on the basis of building permits issued in the main towns allowing greater weight to Jaffa and Tel Aviv where the buildings are mainly of concrete. The Jewish share amounts to £P .21,400.

69. Companies registration fees, amounting to £P.117,389, have been allocated on the basis of profits of local companies as shown in the income tax statistics. The Jewish share amounts to 73 per cent. or £P.79,500.

70. Stamp duties, amounting to £P.269,331, are mainly derived from commercial transactions, preponderantly from companies.

576