| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

British Mandate: A Survey of Palestine: Volume II - Page 578 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

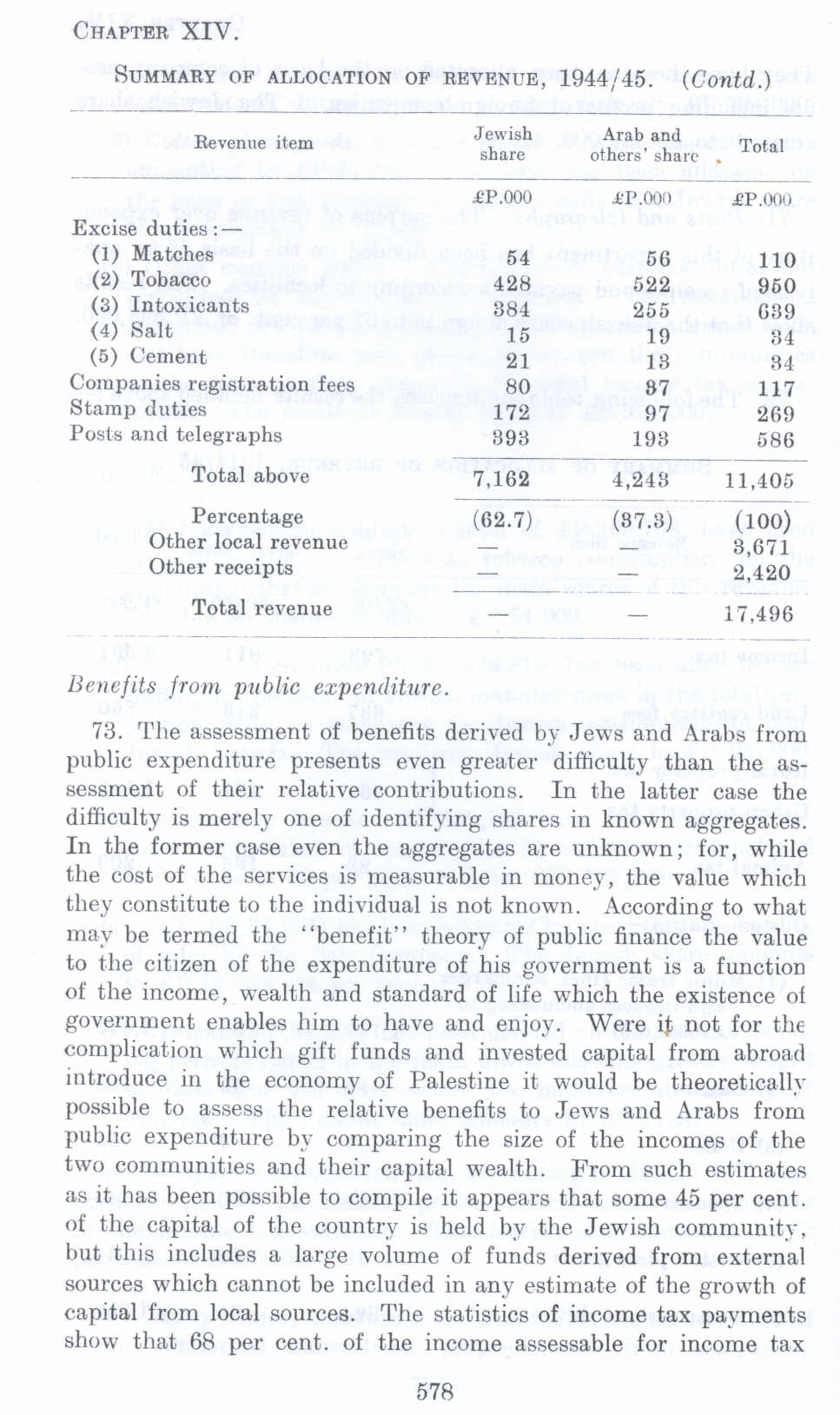

SUMMARY OF AI.LOCATION OF REVENUE, 1944/45. (Contd.)

Revenue item Jewish Arnb and Total

share others' share

£P.OOO .er.oon £P.OOO

Excise duties:-

(1) Matches 54 56 llO

(2) Tobacco 428 522 960

(3) Intoxicants 384 255 639

(4) Salt 15 19 34

(5) Cement 21 13 34

Companies registration fees BO 87 117

Stamp duties 172 97 269

Posts and telegraphs 393 193 ess

Total above 7,162 4,243 11,405

--

Percentage (62.7) (87.3) (100)

Other local revenue - - 8,671

Other receipts 2,420

Total revenue - 17,496

Benefits from public expenditure.

73. The assessment of benefits derived by Jews and Arabs from public expenditure presents even greater difficulty than the assessment of their relative contributions. In the latter case the difficulty is merely one of identifying shares in known aggregates. In the former case even the aggregates are unknown; for, while the cost of the services is measurable in money, the value which they constitute to the individual is not known. According to what may be termed the "benefit" theory of public finance the value to the citizen of the expenditure of his government is a function of the income, wealth and standard of life which the existence of government enables him to have and enjoy. Were it not for the complication which gift funds and invested capital from abroad introduce in the economy of Palestine it would be theoretically possible to assess the relative benefits to Jews and Arabs from public expenditure by comparing the size of the incomes of the two communities and their capital wealth. From such estimates as it has been possible to compile it appears that some 45 per cent. of the capital of the country is held by the Jewish community , but this includes a large volume of funds derived from external sources which cannot be included in any estimate of the growth of capital from local sources. The statistics of income tax payments show that 68 per cent. of the income assessable for income tax