| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

Land Taxation in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Supplement - Page 30 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

(p. 243)

(§ 52)

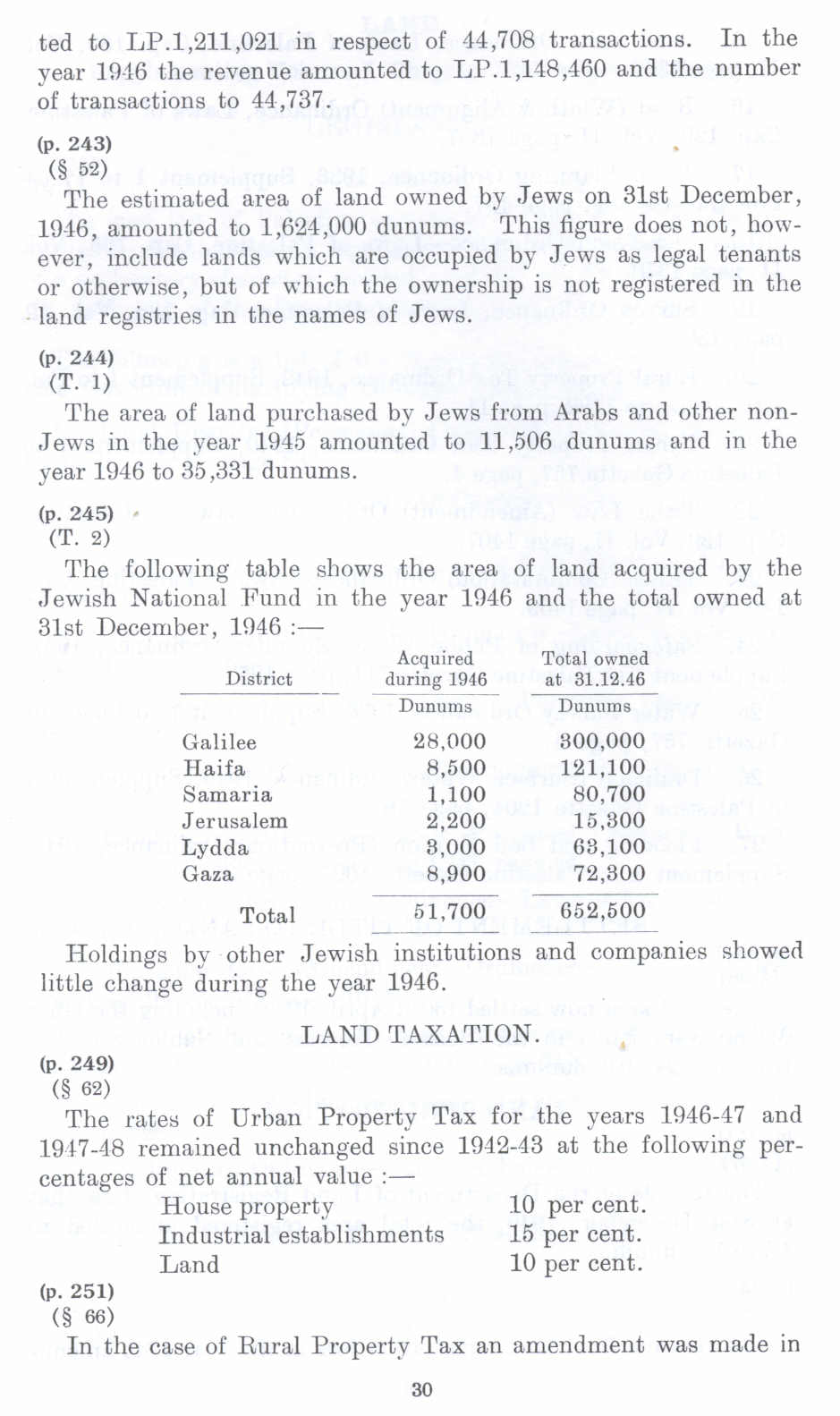

The estimated area of land owned by Jews on 31st December, 1946, amounted to 1,624,000 dunums. This figure does not, however, include lands which are occupied by Jews as legal tenants or otherwise, but of which the ownership is not registered in the land registries in the names of Jews.

(p. 244)

(T. 1)

The area of land purchased by Jews from Arabs and other non Jews in the year 1945 amounted to 11,506 dunums and in the year 1946 to 35 ,331 dunums.

(p. 245)

(T. 2)

The following table shows the area of land acquired by the .Jewish National Fund in the year 1946 and the total owned at 31st December, 1946 :-

District

Galilee Haifa Samaria Jerusalem Lydda Gaza

Total

Acquired during 1946 Dunum

28,000 8,500 1,100 2,200 3,000 8,900

51,700

Total owned at 31.12.46 Dunums

300,000 121,100 80,700 15.300 63,100 72,300

Holdings by other Jewish institutions and companies showed little change during the year 1946.

652,500

(p. 249) (§ 62)

LAND TAXATION.

The rates of Urban Property Tax for the years 1946-47 and 1947-48 remained unchanged since 1942-43 at the following percentages of net annual value :House property Industrial establishments Land

10 per cent. 15 per cent. 10 per cent.

(p. 251) (§ 66)

In the case of Rural Property Tax an amendment was made in

Page 30